Liberal opinion is invariably opposed to “nationalism”. It treats “nationalism” as a homogeneous term that…

Keynes or New-Keynesian: Why Not Teach Both? Rohit Azad

For economists, the Great Recession, the worst crisis the world economy has seen since the Great Depression of the 1930s, has highlighted the need for plurality in macroeconomics education. Ironically, however, there is a move towards greater insularity from alternative or contrasting points of view. Where as, what is required for vibrant policy making is an open-minded academic engagement between contesting viewpoints. In fact, there does not even exist a textbook which contrasts these contesting ideas in a tractable manner. This blog post is as an attempt to provide certain pointers towards developing macroeconomics in a unifiedframework.

Macroeconomics as a subject proper came into existence with the writings of John Maynard Keynes[i]. There were debates during his time about how to characterise a capitalist economy, most of which are still a part of the discussion among economists. Keynes argued that capitalism is a fundamentally unstable system so the state needs to intervene to control this instability.

Interpretations of Keynes and the (In)Stability of Capitalism

Despite the clarity with which he wrote, Keynes has been interpreted in different, often contradictory, ways. In today’s context, they can be broadly classified in two categories: Post Keynesian (PK) and New Keynesian (NK). I would like to place the IS-LM model, the starting point of most undergraduate textbooks, as a precursor to NK. Hence it is a part of the latter because it belongs to a similar interpretation of Keynes and the New Keynesian 3-equations framework can be easily compared to the IS-LM-PC model.

The central distinction between the two interpretations lies in what constitutes the short run. For the New Keynesian framework, it’s the period during which prices (and wages) are rigid whereas for the Post Keynesian tradition, it is one during which investment is rigid. Their long-term versions, therefore, are when prices are fully flexible (resulting in supply-driven growth models like Solow-Swan, Cass-Koopmans and endogenous growth theories) and investment is endogenised (demand driven growth models whether of the Kaleckian or the Harrodian varieties) respectively. Accordingly, my argument of a holistic approach to macroeconomic pedagogy holds true for growth theory as well. But that’s perhaps for another blog post!

In what follows I discuss the two traditions through a simple labour demand schedule. At times, simplest of the diagrams are the easiest to disentangle the complexities of an argument.

The central question that Keynes raised was whether capitalism is a self-regulating system i.e. it reaches full utilisation of capital and/or labour or fundamentally unstable i.e. in generalthere is a simultaneous underutilisation of capital and unemployment of labour?

The theoretical superiority and rigour of Keynes comes from the fact that he could demonstrate the instability in a world with full price flexibility (competitive markets). This to my mind is the one of the central distinctions between Keynes and the New Keynesian tradition[ii]. Unlike Keynes, the New Keynesian version assumes imperfect competition with rigidity in prices, which provides non-neutrality to money. Is this distinction important? I believe Keynes’ abstraction of a world with flexible prices is to show that even in a world of full price flexiblity, both labour and capital can remain underutilised, so, price/wage rigidities are not the cause of unemployment. That perfect competition is far removed from reality is not a weakness of Keynes’s argument. Instead, I believe, this theoretical abstraction shows the beauty and resilience of his argument against the orthodoxy prevalent during his time (and ours as embodied in the mainstream tradition today).

Would Keynes be a New Keynesian?

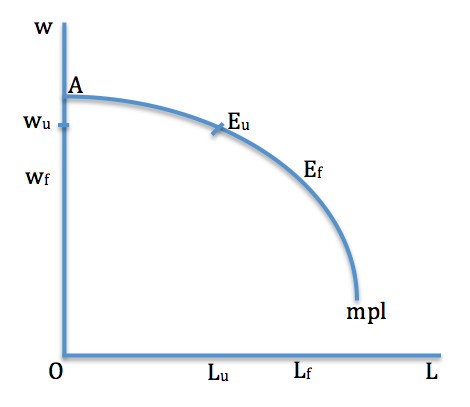

To understand the Keynesian argument in the simplest possible terms, which will make it easy to contrast it with the IS-LM[iii] as well as the NK variety of “Keynesianism”, I use the marginal product curve of labour, which is also the demand for labour[iv]. L is labour and w is real wage in the diagram below. We know that the area under the mpl is the total output. If the full employment level of labour is Lf, an economy settling at a level of employment less than that entails unemployment.

But why would an economy settle down at any level other than Lf was the debate during Keynes’ times and continues to be during our time. Since there are two variables in the diagram here, real wage and employment, only one of them can be rigid (in the sense of being given from outside the system of these two variables) at a time with the other being completely flexible, which gets determined simply by virtue of being the corresponding point on the mpl.

The easiest way of appreciating the difference between the two macroeconomic ‘camps’ is to identify which one they consider as rigid in explaining unemployment in the economy[v]. While Keynes believed employment is rigid and real wages completely flexible, NK believe the opposite. These two positions might seem as merely differing in details but nothing could be further from the truth. Not only does the policy prescription arising out of the two, which we discuss below, represent two opposite ends of the political spectrum, their understanding of capitalism is completely at odds with each other. Keynes’ argument shows that capitalists, driven by uncertain expectations, decide the level of employment in the economy whereas the NKs blame inter-worker rivalry (unions, efficiency wages) for their own fate. NKs, therefore, absolve the capitalists of the instability their investment decisions create. NKs are essentially Marshallians masquerading as Keynesians! You remove the rigidities from their models and you are in Friedman’s world. No wonder their long-run versions of capitalism are the same.

But why did Keynes argue that employment, instead of real wages, is rigid? The rigid level of employment is created through a combination of stock and flow equilibria. Wealth owners have a choice between staying liquid, indirect claims over capital assets (shares, bonds etc.) and capital assets directly. Only the latter two constitute investment demand. The liquidity premium (interest rate), along with the expected profitability on investment goods, is what limits the demand for the latter two. Since both the expected profitability and liquidity premium are based on subjective assessment of capitalists, there’s no inherent mechanism that will generate a high enough investment demand, and, hence, employment in the investment sector. Keynes was aware that investment is not the only source of employment since the income generated due to the investment generates subsequent cycles of consumption demand which adds to the overall employment (this is the flow equilibrium working through the process of the employment multiplier). Since the propensity to consume is less than one, this is, however, a limiting cycle with the total employment determined by the initial investment sector employment. The total output demand generated between the two sectors is given by the area AEuLuO in the figure and the real wage wu comes out of the wash, so to speak. The only way that full employment can be ensured is if ex ante investment was at a level to generate a total demand equivalent to AEfLfO in the figure. This is what Keynes called a special case of his general theory and the economy getting stuck at a point other than this special case had nothing whatsoever to do with rigidity of wages. In fact, for equilibrium to exist in Keynes’ framework, the real wages have to be flexible[vi].

What about the NK version of unemployment? In its IS-LM avatar, the reason for why the economy settles down at a lower than full employment level of output is because the price is rigid, which limits the LM curve to a point where it intersects the IS curve ahead of the full employment level. In the newer versions, NK essentially provides the microfoundations for such rigidities, whether in prices or wages. Different attempts have been made in this tradition to explain why the labour market stabilises at real wage rates, say wu in the diagram, which is higher than its market clearing level, thereby, generating involuntary unemployment. They can be categorised as follows: (a) efficiency wage due to adverse selection, labour turnover, shirking, fairness; (b) insiders wield a higher bargaining capacity than the outsiders. Once the real wage has been determined, the level of employment Lu comes out of the wash so to speak, the exact opposite of what Keynes argued.

Policy Implications of New Keynesian and Keynesian Interpretations

Having looked at the causal structure of these two frameworks, let’s look at the policy side of this debate. It follows that the remedy to the problem of unemployment would vary according to what the diagnosis is. So, the Keynesians believe in policies that push up the employment level directly through the government sector, which generates its own employment multiplier. A more radical recommendation that Keynes made to address the premium that liquidity demands – a lesson ever more relevant in today’s world dominated by finance – was euthanasia of the rentiers, a propertied class which lives off the rents extracted from the real sector. As opposed to this, the NKs recommend, among other right-wing policies, removal of frictions in the labour market, which is a politer version of recommending union busting, and restrictions on monetary policy other than towards the sole objective of inflation targeting (remember they are closet Friedmanians).

Rohit Azad is Assistant Professor at the Centre for Economic Studies and Planning, Jawaharlal Nehru University (JNU), Delhi.

An article-length version of this appeared as ‘Plurality in Teaching Macroeconomics’ in the Economic & Political Weekly (EPW), March 31, 2018.

End notes

[i] While Michal Kalecki arrived at most of the Keynesian conclusions simultaneously with, or in some cases before, Keynes, he was inaccessible to the English readers as his initial writings were in Polish.

[ii] The post-Keynesian tradition too assumes imperfect competition, which, although more realistic, I believe, blunts the theoretical charge that Keynes was mounting on the economic orthodoxy of his time. It is important to make this distinction otherwise it gives the impression that Keynes/post-Keynesianism is about price rigidity, which they absolutely are not.

[iii] Joan Robinson in her famous Economic heresies had written this about the IS-LM interpretation of Keynes:

If Keynes’ own ideas were to be put into this diagram, it would show IS as the volatile element, since it depends upon expectations of profit; the case where full employment cannot be reached by monetary means would be shown by IS falling steeply and cutting the income axis to the left of full employment.

[iv] Without going into the capital controversy, one can imagine co-existence of different kinds of machinery with different labour coefficients. Marginal product curve of labour in that case represents a ‘step-function’ starting with the machinery with the lowest labour coefficient. Such a way of looking at the marginal product does not require a humbug ‘production function’.

[v] In the PK framework, both real wages and employment are rigid because they take the real wages to be determined by markups. But the cause of unemployment even there is not the rigidity of markups (or in effect real wages) but the rigidity of employment arising out of the same reasons as what Keynes had described.

[vi] Keynes in The General Theory, ch. 17, wrote the following on real wage rigidity:

If, indeed, some attempt were made to stabilise real wages by fixing wages in terms of wage-goods, the effect could only be to cause a violent oscillation of money-prices. For every small fluctuation in the propensity to consume and the inducement to invest would cause money-prices to rush violently between zero and infinity. That money-wages should be more stable than real wages is a condition of the system possessing inherent stability.

(This article was originally published in Developing Economics on June 26, 2018)