Liberal opinion is invariably opposed to “nationalism”. It treats “nationalism” as a homogeneous term that…

Economic Recovery or A Statistical Illusion: Some Observations on Recent Estimates of GDP Growth Vikas Rawal

On November 30th, the Central Statistical Office (CSO) came out with quarterly estimates of GDP for the second quarter (June to Sep) of 2017. Predictably, analysts and spokespersons of the government spent the evening in newsrooms of various TV channels celebrating what they claimed was a sign of revival of the economy. Next morning, revival of economy was the front page news in almost every newspaper. If there was any adverse impact of demonetisation and GST, it was claimed, here was the evidence that such an impact was only short-term and had started to wane. The subtext was that the golden times, the promised achhe din, were finally round the corner.

But is the economy really on course to revival? What are these numbers and how seriously should one take them?

The data released by the CSO on November 30th showed that year-on-year growth in the second quarter, 6.3 per cent, was marginally higher than the year-on-year growth in previous two quarters (5.7 per cent for Q1 and 6.1 per cent for Q4). The increase – from 6.1 per cent and 5.7 per cent to 6.3 per cent – was rather marginal and, for that reason alone, celebrations in the media seemed rather premature. A more careful examination of data released by CSO suggests that even this marginal change may have been a result of statistical jugglery rather than of any substantial change in the real economy.

Quarterly data are based on quick estimates and projections for different segments of the economy. The underlying estimates and projections are neither comprehensive nor very accurate. Estimates of gross value added for agriculture and allied sector are based on advance estimates of production, which are essentially a reflection of what the governments wish would happen given the weather conditions that prevailed in the period. In the current GDP series, estimates for manufacturing sector and other industrial activities are based on returns filed by companies to the Ministry of Corporate Affairs. In absence of any information for the informal sector and the small-scale firms, trends for large firms in various industrial sectors are used to make estimates for the entire sectors. For activities in the household sector, estimates are little more than guesses and speculations.

Quarterly estimates are created to get a broad sense of the direction of change in the economy. Given that these are based on limited data, the are supposed to be used with caution. However, given government’s desperation to show that the economy was on course to revival, caution was thrown to wind and no one seemed to care.

A problem with estimation of economic growth from quarterly data is that such estimates have to control for seasonal fluctuations in different sectors of the economy. On account of seasonal variations, comparing GDP of one quarter with the GDP of the previous quarter is not meaningful. CSO deals with this problem by reporting year-on-year growth rates for each quarter. That is, the growth is estimated for each quarter by comparing it with the same quarter of the previous year. As I show below, year-on-year growth rates based on quarterly data are also very problematic and misleading.

The pattern of seasonality varies greatly between different sectors of the economy. Data on sectoral composition of gross value added (GVA) show that, of all the sectors of economy, seasonality is strongest in agriculture. This is not surprising as agricultural production is strongly dependent on monsoon and temperature conditions. In comparison with other sectors, there are two peculiarities in seasonality of agriculture: first, the magnitude of variation across quarters is very high, and secondly, seasonality of agriculture follows the same pattern each year.

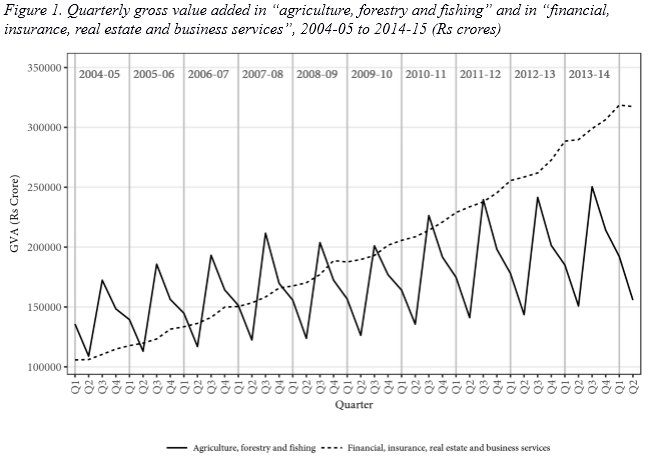

If we look at the 2004-05 series of GDP, between 2004-05 and 2014-15, variation of GVA of agriculture and allied activities across four quarters was about 40 to 50 per cent of the mean GVA of the sector. As seen in Figure 1, GVA of agriculture and allied activities peaks every year in the third quarter, when kharif crop is harvested. GVA of this sector falls in Q4, and then falls further in Q1 and Q2 of the next year, to rise back again in Q3, when the next kharif crop is harvested. This pattern is repeated year after year without exception.

It should be noted that there is no peak in the data corresponding to the rabi harvest. This is because rabi harvest happens in Q4 (Jan-Mar) in warmer climates of eastern and southern India and in Q1 (Apr-Jun) in north India. Also, there is no rabi crop on unirrigated lands in many parts of India. The fact that there is no peak corresponding to even the rabi harvest, the season in which a major crop like wheat is harvested, shows the dominance of southwest monsoon in driving the seasonality in agricultural production in India.

In the 2004-05 series of GDP, data for some of the other sectors also show seasonal cycles but these are neither as sharp as for agriculture nor as systematic. In case of manufacturing, construction and “trade, hotels, transport and communication”, there are small peaks in the fourth quarter (Q4), presumably because of some accumulated activities taking place (or getting accounted for) at the end of the financial year. It is noteworthy that no peak is visible in the data for non-agricultural sectors in Q3, the quarter in which many of the festivals fall.

In 2015, CSO discontinued the 2004-05 series of GDP and introduced a new series with the base year 2011-12. Changes introduced in the new series and their implications for the estimates of growth have been a subject of considerable controversy. There is, however, one peculiar feature in the quarterly data for the new series that has escaped scrutiny so far.

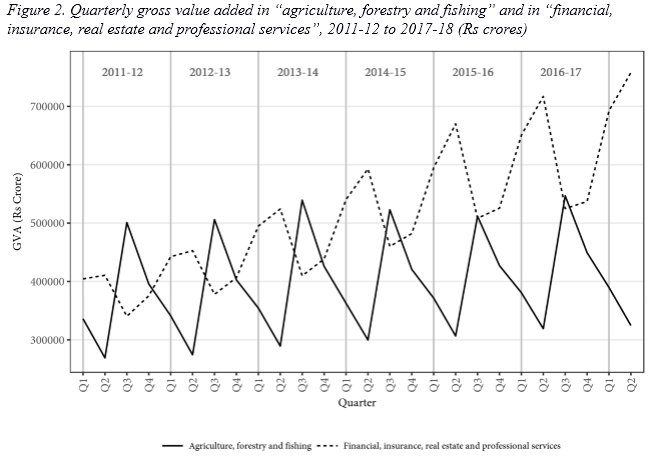

The pattern of seasonality in GVA for agriculture in the new series is very similar to the pattern seen in the old series. That is, GVA for agriculture is highest in Q3 and is lowest in Q2 (Figure 2). However, surprisingly, estimates of gross value added for “financial, insurance, real estate and professional services” show a pattern of seasonality that is very different in the two series. While data for “financial, insurance, real estate and professional services” in the earlier series of GDP (with 2004-05 base year) showed no significant seasonal variation, corresponding data in the new series show a very strong seasonal pattern (see Figures 1 and 2).

As can be seen in Figure 2, the magnitude of seasonal fluctuations in GVA of “financial, insurance, real estate and professional services” in the new series is almost as large as the seasonal fluctuations in GVA of agriculture and allied activities. What is even more remarkable is that the seasonal cycle of this variable in the new series is as systematic as the seasonal cycle for agriculture, and is counter-cyclical to agriculture. Estimates for this series peak in Q2, when GVA of agriculture is the lowest. Of all the four quarters, estimates for “financial, insurance, real estate and professional services” are lowest in Q3, the quarter in which GVA for agriculture peaks because of kharif harvest. It may be noted that while there have been some changes in the classification of activities between the old series and new series, there is no activity in this sector which should have such a strong seasonality.

It should be noted that none of the activities covered under this head are seasonal in any significant way. Given this, the strong counter-cyclical seasonal movement of this series makes the estimates for “financial, insurance, real estate and professional services” seriously suspect. This is confirmed by the fact that the corresponding series in the 2004-05 GDP data showed no significant seasonality.

In the new GDP series, GVA estimates for this sector peak in the second quarter. As a result, year on year growth for the second quarter – 6.3 per cent growth which made the headline news on December 1st – is largely on account of growth of this sector. In terms of the absolute increase in gross value added between the Q2 of 2016-17 and 2017-18, about 24.5 per cent has taken place on account of this sector. Given this, the revival of growth seems to be little more than a statistical illusion created using doubtful data.

Over the last one year, flawed policies and priorities of the present government have pushed the economy into a tailspin. No amount of statistical jugglery can hide the fact that, in absence of a fundamental course correction in economic policies, economic revival is nowhere on the horizon.