The weaponization of tariffs by US President Donald Trump has clearly generated fear and loathing…

The Mystery about Investment C. P. Chandrasekhar and Jayati Ghosh

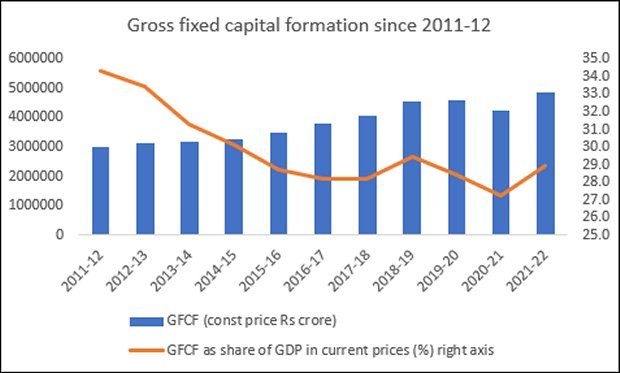

One persistent macroeconomic concern in the Indian economy over the past decade has been the continuing decline or stagnation in investment rates. The decline began after 2010, that is before the tenure of the Modi government, but it continued thereafter. As Figure 1 shows, even the slight recovery in investment (gross fixed capital formation) in 2021-22 left real investment only 6 per cent higher than the previous peak of 2019-20. But more significantly, while the investment rate (gross fixed capital formation as a share of GDP) in 2021-22 also recovered to some extent, it was still below the rate in 2018-19, and nearly 6 percentage points lower than the rate in 2011-12.

Figure 1

Source for all figures: Calculated from MOSPI National Accounts Statistics

This story of declining investment rates for more than a decade is certainly at odds with the official narrative of a resurgent and buoyant economy which is also being widely propagated within and outside India. It also presents a stark contrast with stock market behaviour—although it is well-known that stock market indices in India have never been a good indicator of either real investment or the state of the rest of the economy.

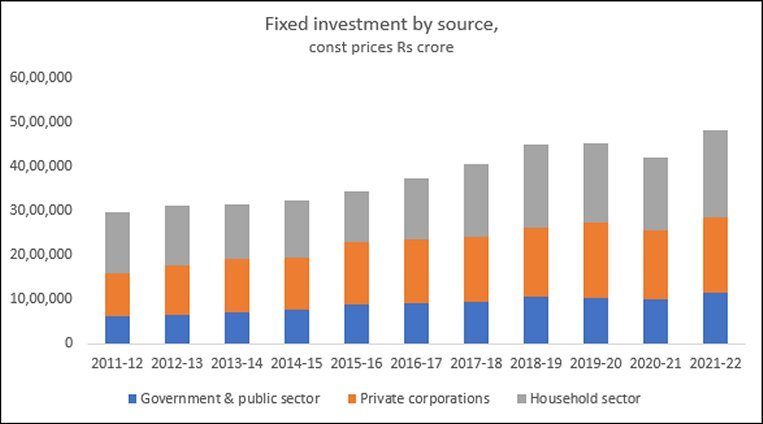

What is behind the more aggregate story on overall investment behaviour? It is worth undertaking a more disaggregated analysis that considers the different elements of investment. Figure 2 presents the evidence on fixed investment in constant price terms, categorised according to public, private corporate and household sectors. (The public sector includes general government as well as public non-financial and financial companies; the private sector includes private non-financial and financial companies.)

Figure 2

One of the most striking features of this is the very significant role played by the household sector in total fixed investment. Note that the method of calculating household investment is only as a residual: “Household investment in fixed assets is derived as residual deducting the corresponding estimates of public and private corporate sector from the total capital formation by assets plus change in stock.” (https://mospi.gov.in/136-saving-and-capital-formation) At the start of this period, for the 3-year average of 2011-12 to 2013-14, household investment accounted for 42.6 per cent of total fixed investment. By the close of the period, for the average of 2019-20 to 2021-22, the share of household investment was 39.5 per cent. This was a slight decline, but still meant that household investment (which includes not only personal investment in dwellings, etc. but also the estimated investment by unregistered small and micro enterprises) amounted to around two-fifths of total investment.

This significance of household investment points to the continuing importance of informal activity in the Indian economy, not only in total employment, but also in determining aggregate investment and the level of economic activity. This is worth noting because it means that a focus on providing incentives only for investment by the private corporate sector may well come up wanting.

The other point to note is the persistent role of government and public investment in contributing to total investment. This accounted for 21.6 per cent of total investment in the first 3-year period; by the last 3-year period the share had gone up to 23.4 per cent. So the private corporate sector, which is the focus of so much of the government’s economic policy making has only accounted for slightly more than one-third of total investment throughout this period. Despite various incentives and blandishments, private corporate investment largely stagnated between 2015 and 2018. The sharp reduction in corporate income tax in September 2019, which is estimated to have a revenue loss of around 2 per cent of GDP for the exchequer, and even in 2020-21 lost the government more than Rs 1 lakh crore, also did not have much effect in stimulating investment. As it happens, private corporate investment fell in 2020-21, although that was also related to the effects of the Covid-19 pandemic and lockdowns. The recovery in private corporate investment in 2021-22 brought it to a level only 1.1 per cent above the level of two years previously—a real surprise given the supposed V-shaped recovery that was much advertised at the time.

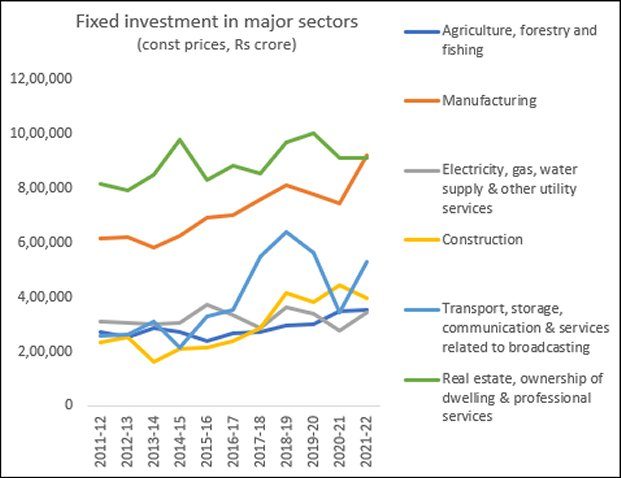

Figure 3

Figure 3 describes the movement of real investment (in constant price terms) by major sector. The good news here is that there appears to be an uptick in manufacturing investment, which is clearly a good sign given the urgent need to put manufacturing activity in the economy on a stable and growing trajectory. Investment in construction grew from 2014 until 2018, but thereafter appears to have stagnated. Similarly, investment in transport, storage and communication, which can involve some bulk investment especially in telecom equipment, showed a sharp increase in the three years between 2017-18 and 2019-20, but otherwise was broadly in line with GDP growth.

The real story is that of how dominant the real estate sector has been in total investment. However, after a peak in 2014-15, investment in real estate has fluctuated around a stagnant trend, such that its share of total investment fell from 25.5 per cent in 2011-12 to 18.3 in 2021-22.

Such disaggregation further confirms the broader macroeconomic story behind the overall decline and then stagnation in investment rates. The underlying cause is inequality, which has been the defining feature of economic growth in India over the past decade. As the stimulus for and the fruits of economic expansion accrue to a relatively small part of the Indian population, the lack of much improvement in the material conditions of the majority mean that a large domestic market for mass consumption goods does not develop as much as it could have. This conclusion is confirmed by other evidence, such as the decline in two-wheeler sales even as the demand for luxury passenger vehicles explodes.

It is true that even if a decile or slightly more of the Indian population experiences rapid income growth, that certainly creates a market of around 150-200 million people. But the economies of scale that would result from catering to a market of more than 1.4 billion people are surely much greater. And the rich and middle classes in India are increasingly more willing and able to consume imported goods, making it more difficult for domestic producers to establish dominant market presence. Large private corporate investors looking for such economies of scale are not finding them in today’s economy, and in some sectors they are seeing flat or even declining demand. This is surely one of the more significant reasons for the slowdown in investment rates as well.

This means that reviving investment in India must also be about reducing inequality and ensuring sufficient incomes especially in the bottom half of the population, to generate a dynamic mass market. In turn, this means seeing wages not just as costs that have to be suppressed, but as sources of demand that are crucial for investment.

(This article was originally published in the Business Line on February 05, 2024)