Donald Trump’s top economic advisor claims the President has weaponised tariffs to ‘persuade’ other nations…

Maldives: Debt and dependence C. P. Chandrasekhar and Jayati Ghosh

As the distance between Maldives and India widens, with the latter being asked to withdraw its uniformed personnel stationed in the former, questions are being asked about how Maldives will manage without India’s help on the economic and regional security fronts. As if echoing that sentiment, in Article IV consultation reports following the COVID pandemic year 2020, the IMF has been underlining the country’s vulnerability to external and overall debt distress. The Maldivian President Mohamed Muizzu, who won an election his party fought on an anti-India platform, appears convinced that with Chinese support he can do without India. He clearly sees that support as being adequate to bolster Maldivian trade, capital flows and tourist arrivals and ensure economic stability.

That has been a concern for the Indian government, which, following the COVID pandemic, had raised bilateral disbursements of long-term credit and grants. This included the use of swap arrangements with the Reserve Bank of India to the tune of $400 million in 2020. The sum was paid back in full in two tranches, an early payment of $150 million in January 2021 and the balance of $250 million end-December 2021. Excluding that, Indian holding of Maldivian debt has been less than 10 per cent in all years since 2018.

The growing closeness to China of an island economy in the Indian Ocean region also bothers the US, which has been troubled by China’s growing global presence and influence. With the IMF clearly allied with the US in its strategic interventions, there is reason to believe that its repeated proclamations that Maldives is on the brink of external debt default (besides internal financial disruption) is a call to the country to cut back spending financed with Chinese support.

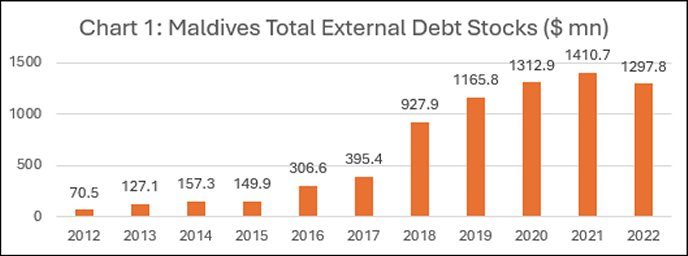

The evolution of Maldivian external debt does suggest that there is cause for such suspicion. Having risen gradually from $942 million in 2012 to $1,465.7 million in 2017, the stock of external debt owed by Maldives registered a spike to $2,322.9 million in 2018 and then rose to a peak of $4,163.4 million in 2021, before settling at $4,033.8 million in 2022 (Chart 1). Much of this shift onto a higher debt strategy was on account of flows from China as well as the decision of the Maldivian government to follow the example of many other small less developed countries to exploit the interest of yield-seeking global investors with access to cheap liquidity, by issuing sovereign bonds.

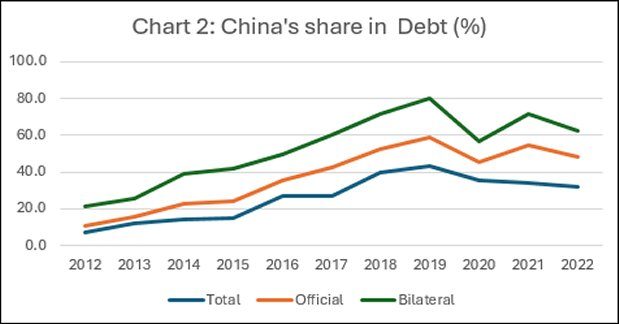

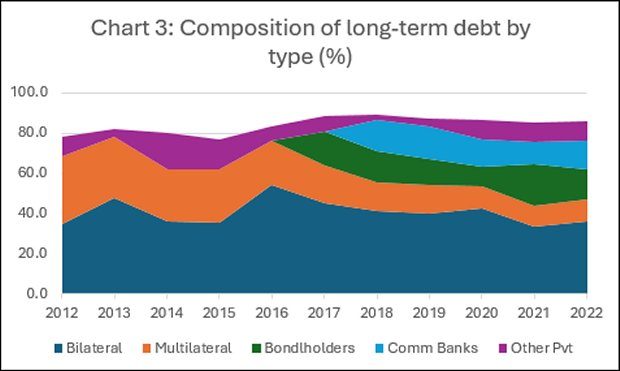

Thus, the stock of Maldivian external debt held by bondholders rose from an initial $250 million in 2017 to $350 million in 2020 before spiking to $850 million 2021 and then $600 million in 2022 (Charts 2 and 3). But the remarkable shift was the rise of China’s share in overall Maldivian external debt from 7.5 per cent in 2012 to 14.9 per cent in 2015, 26.9 per cent in 2016, and 39.9 per cent and 43.5 per cent in 2018 and 2019 respectively.

Subsequently, partly because of the emergence of bondholder debt and some increase in flows from India, China’s share came down to 32.1 per cent in 2022. India’s share, which stood at 15.4 per cent in 2016, fell to 3.8 per cent in 2021 before rising to 8.1 per cent in 2022. The use of the RBI swap in COVID year 2020 placed that figure at 12.4 per cent. During those years, the share of lending from multilateral banks and institutions (like the World Bank and the Asian Development Bank) fell continuously from 33.6 per cent in 20212 to 10.9 per cent in 2022.

These trends have meant that China has emerged the principal official creditor to the Maldives, with its share in official (bilateral and multilateral) credit standing at 58.9 per cent of the total in 2019 and 48 per cent in 2022, and in bilateral credit alone at 80.1 per cent and 62.4 per cent respectively in those two years.

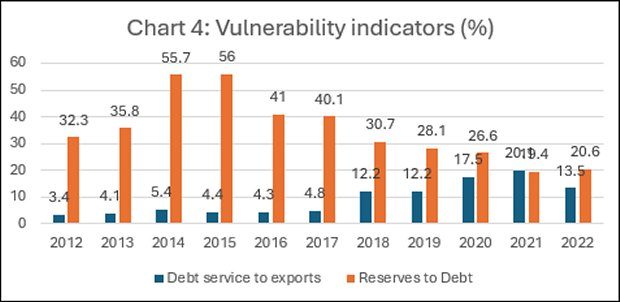

Developments on the debt front have also resulted in a rise in vulnerability indicators, allowing the IMF to identify the country as being on the verge of debt distress. To start with, the ratio of debt service to exports jumped from 4.8 per cent in 2017 to 12.2 per cent in the subsequent two years. It then spiked to 17.5 per cent in COVID year 2020 and 20.1 per cent in 2021, when receipts from tourism fell sharply. It remained at 13.5 per cent in 2022. Simultaneously, the ratio of reserves to external debt, which stood at a high of 56 per cent in 2014 and 2015, fell to around 20 per cent in 2021 and 2022.

While clearly these trends are concerning, the IMF’s negative assessments tend to discount two features of these developments. First, the observed dominance of China in both the overall external debt exposure of Maldives, and in particular its dominance in overall official and bilateral debt exposure. Given the small size of Maldives’ debt to China relative to the latter’s reserves and its aggregate external lending, China is in a position to restructure and/or waive a significant volume of debt, enhancing its growing influence over the island nation. According to reports, among the many key agreements signed to launch a Comprehensive Cooperative Strategic Partnership between China and the Maldives during President Muizzu’s early-January visit to China, was one that provided for grant assistance. The sums involved were not revealed but could easily be of a magnitude that helps the Maldives stay afloat while it restores balance of payments stability as tourism revives.

Second, the IMF has increasingly tended to assess a country’s vulnerability to debt distress by taking account of the volume of aggregate public debt or external and domestic debt combined relative to the nation’s GDP. That is clearly misleading for a number of reasons. It conflates external debt that needs to be serviced with foreign currency with domestic debt that must be serviced in local currency which the government controls. And it ignores the fact that as a result of the exceptional collapse of economic activity that the COVID-19 pandemic induced, GDP and government revenues fell sharply, resulting in a sharp increase in the ratio of public debt and debt service to other normalising variables, even though much needed pandemic related expenditures were kept down. In the Maldives case, the ratio of external debt to GDP rose sharply to 108 per cent in 2020 and remained at highly elevated levels in the next two years.

This is not to deny that Maldives, like other small island states, is facing debt stress of a kind that is not easily resolved by the domestic government. But this is stress of a kind that can be easily dealt with by the international community, without forcing austerity on the debtor or leaving it to be resolved by one or more countries that offer assistance with significant strategic interests in mind. Since Maldives is among the countries that is vulnerable to global warming and climate change effects and needs to spend significantly on adaptation and addressing loss and damage, countries that are responsible for the carbon emissions that has rendered the likes of Maldives vulnerable must provide the funding needed to build the required resilience. That should be the IMF’s basic concern.

(This article was originally published in the Business Line on February 19, 2024)