The Global Conference Towards a needed Paradigm Shift in Economic Policy: Addressing Industrial Development and…

The Injustice Contained in Global Fiscal Indicators C. P. Chandrasekhar and Jayati Ghosh

The sovereign debt crises confronting many low and middle income countries is now common knowledge and is frequently referred to by global policy makers—even though remarkably little is being done by the international powers-that-be to resolve these crises. The general presumption is that many of these countries experienced dramatically increased sovereign (external) debt stress because of the Covid-19 pandemic. This is seen to have inevitably caused public revenues to fall because of lockdowns and the impact of the disease, even as public spending had to increase for the very same reasons. Low and middle income countries are then seen as victims of forces beyond their control that forced government deficits to rise in ways that are now being punished by debt markets.

But is this an accurate account of what really happened? Did low and middle income countries spend way beyond their means during the pandemic and the aftermath, so that their public debt levels rose dramatically? It turns out that in fact the increase in public spending by these countries as a group was relatively modest, certainly when compared to the massive increases in public expenditure (and consequent deficits) in the advanced economies.

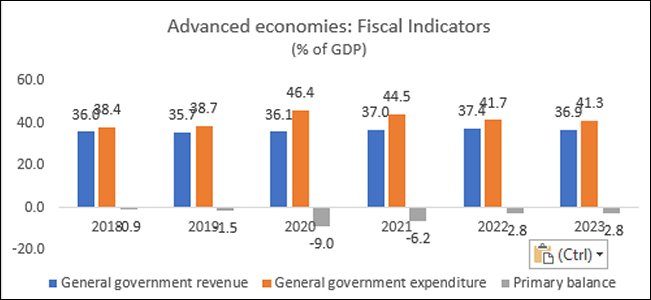

Figure 1a describes the trends in general government revenue, expenditure and primary fiscal balance as shares of GDP from 2018 to 2023, for the group of advanced economies. (All data in all the figures are from the IMF Fiscal Monitor April 2023, and the numbers for 2023 are IMF projections.) It is clear that the advanced economies as a group definitely did increase their spending significantly in 2020, by around 20 per cent more than in the previous year, or an average of 7.7 per cent of GDP increase in that year alone. Levels of public spending came down thereafter but remained high in 2021, and even in 2022 were 3 per cent higher than in the pre-pandemic year of 2019. In 2020, the US showed the largest increase, going up by nearly a quarter or by 13 percentage points of GDP.

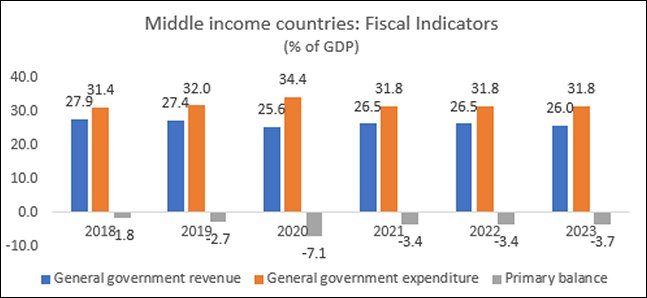

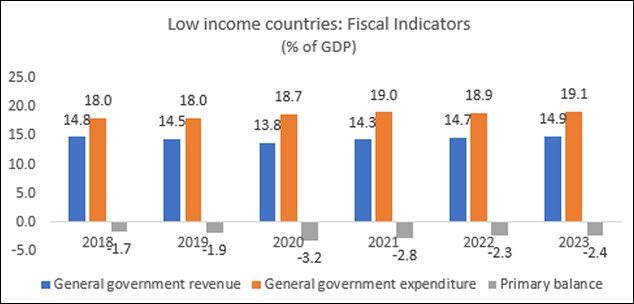

By contrast, as evident from Figures 1b and 1c, middle income countries were much more circumspect, and low income countries were completely cautious, increasing their spending by only 2 per cent and 0.7 per cent of GDP respectively.

Figure 1a

Figure 1b

Figure 1c

Despite such discretion, the primary balances (before interest payments) worsened for both middle and low income country groups. The largest primary deficits were in the advanced economy grouping at 9.0 per cent of GDP in 2020 and 6.2 per cent in 2021. But such deficits also went up to 7.1 per cent in middle income countries—largely because revenues fell more. In fact, since the GDP decline in 2020 was also greater in these countries (other than China), the revenue to GDP ratios underestimate the extent to which government revenues fell.

The primary deficits for middle income countries reduced quickly however, getting back to 3.4 per cent of GDP by 2021. But low income countries’ primary deficit was only 3.2 per cent of GDP even in the peak pandemic year (suggesting that they were able to do even less in terms of social protection and recovery spending) and further reduced to 2.8 per cent of GDP in 2022.

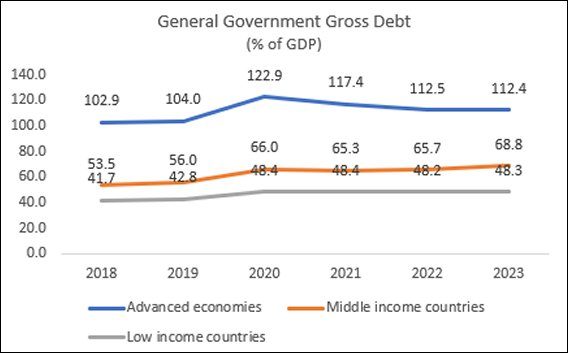

Figure 2

It might be assumed that such fiscal rectitude on the part of low and middle income countries—which really meant that the burden of the pandemic was even greater on people in these countries—should at least be rewarded by lower levels of public debt to GDP after the pandemic. But, as Figure 2 shows, the opposite occurred. Advanced economies already began with significantly higher levels of public debt in 2018, greater than their GDP in average, and these further increased to 123 per cent of GDP in 2020. But then the public debt to GDP level fell in 2021, and continued to fall in subsequent years.

However, there was no such decline in public debt to GDP levels for middle and low income countries. Rather, this continued to increase, even though the ratios remained well below those of the advanced economies.

This brings out two anomalies. Why should public debt levels continue to increase for low and middle income countries that had spent relatively less over the pandemic and contained their primary deficits as well? And if they have significantly lower debt to GDP ratios than the advanced countries, then why should the sovereign debt crises be concentrated in these countries, rather than in the advanced economies that have been more supposedly “profligate” even with higher starting public debt levels?

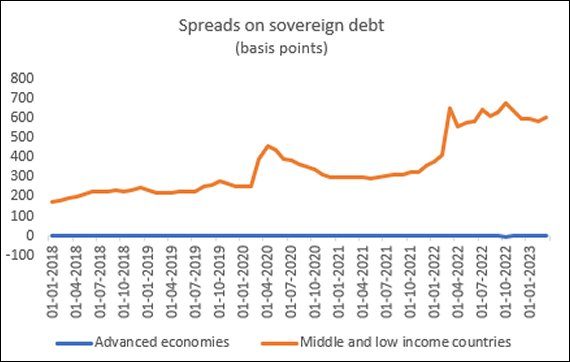

Figure 3

The answer is evident from Figure 3, which encapsulates the inequality and injustice embedded in global financial markets, including the market for sovereign bonds and loans. Low and middle income countries have not had the luxury of operating substantial countercyclical policies like the advanced economies. Instead, they have spent less, run lower primary deficits and kept their debt to GDP levels well below those of advanced economies. But instead of being rewarded for this excessive fiscal prudence, they have been further punished by financial markets, as the spread on their sovereign debt has ballooned from the start of 2020. This is unlike the advanced economies, where on average spreads on sovereign debt have remained low, generally well below 1 basis point.

Clearly, such spreads have little to do with economic “fundamentals” in low and middle income countries, and everything to do with monetary and fiscal policies in the advanced economies. Monetary tightening in the rich world has created a “flight to safety” to rich economies that are not playing by the conservative fiscal rules imposed on poorer countries. And this worsens the sovereign debt problems of these countries no matter how “fiscally responsible” they try to be. And ironically, the very flight of capital makes adverse expectations become self-fulfilling.

This is further proof—in case any were still needed—that capital market integration does very little to help developing countries; rather, it is a major source of problems and constraints on domestic policies.

(This article was originally published in the Business Line on September 21, 2023)