Even Western financial outlets now warn of the beginning of the end of dollar dominance.…

Pakistan’s Debt Crisis: No resolution in sight C. P. Chandrasekhar and Jayati Ghosh

While Pakistan is beset by multiple crises on the political, social and economic fronts, media attention is focused on the debt crisis and analysts are preoccupied with the question whether the IMF would soon release a last tranche of $1.1 billion out of a $6.5 billion loan programme sanctioned in July 2019 and subsequently extended and enhanced. That tranche is presented as a prerequisite for a resolution of the debt crisis facing the country. The government in Pakistan, beleaguered by multiple crises, also seems convinced by this argument and is struggling to meet conditions that have been set by the multilateral institution for release of the sum.

The IMF reportedly is requiring a transition to a market-determined exchange rate that could lead to a steep fall in the exchange rate and aggravate inflation, which is already running at around 30 per cent. It is also demanding further reduction in what it describes as “untargeted” subsidies and further increases in energy prices that have already been hiked.

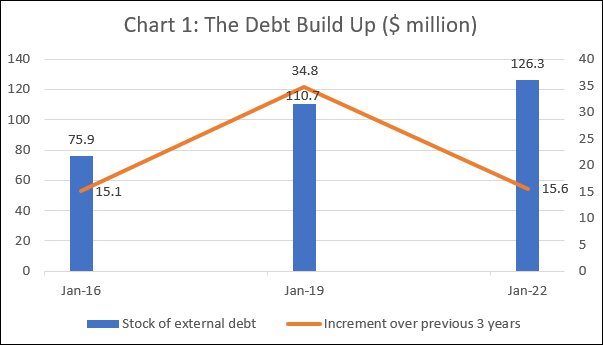

The sum on offer from the IMF is just a small fraction of the country’s total external debt, which was placed at $126.3 billion as at the end of 2022 (Chart 1). It is also unlikely to help Pakistan finance much of the amortisation and interest payments due in 2023 on its accumulated debt. Debt service on all external debt in 2023 is estimated by the World Bank at $26.4 billion.

If Pakistan’s government is still desperate to appease the IMF, it is because of its current precarious situation, in which forex reserves would finance less than a month of imports in normal times. It has exhausted the goodwill of its friends like China, Saudi Arabia and the United Arab Emirates. So apparently the only immediate source of foreign exchange to keep the economy going till some miracle transpires, is the IMF.

The $1.1 billion is virtually the last straw for Pakistan to clutch, since it is unlikely to be able to finance the current account deficit for much longer. In financial year July 2021 to June 2022, the current account deficit was $17.4 billion. So, the amount that the IMF would provide is less than the average monthly value of the current account deficit in 2021-22. Not surprisingly, forex reserves had to be run down and in July-December 2022 imports had to be curtailed to $33.9 billion, down from $44.7 billion in July-December 2021. With foreign exchange not being released, containers carrying food and raw materials are not being cleared at the ports, leading to shortages and production cuts. Shutdowns in power plants are resulting in blackouts across the country. Sustaining even the current level of exports is going to prove difficult. And a default on debt service payments is more than likely.

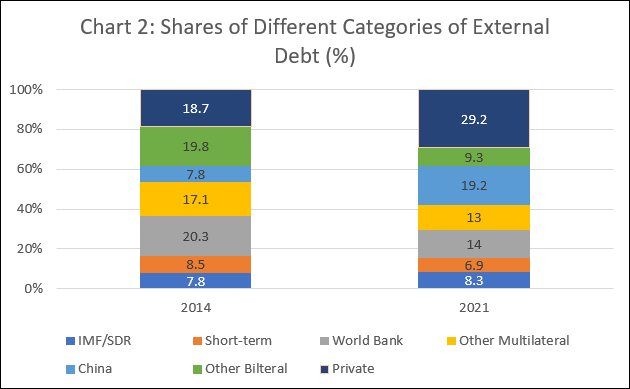

Any resolution of the crisis must involve a considerable reduction in the stock of external debt. That requires creditors taking haircuts, restructuring the residual debt to postpone immediate interest and amortisation payments and extend loan maturities, and ensuring some flow of new capital. As elsewhere, however, resolution is complicated by the structure of debt and how it has changed over time. The role of private creditors—both commercial banks and bondholders—has been growing. Their share in total outstanding debt rose from 18.7 per cent at the end of 2014 to 29.2 per cent in 2021. This share gives such creditors the power to wreck any resolution effort in the hope of getting a better deal, and means that they cannot be kept out of any debt resolution exercise.

This problem is compounded by changes in the structure of official credit. Official creditors still dominate the provision of public and publicly guaranteed debt, accounting for 65 per cent of total debt in 2014 and 55.5 per cent in 2021. Include flows from the IMF and the figures rise to 72.8 per cent and 63.8 per cent respectively. Within official credit, the share of multilateral credit (excluding the IMF’s allocations) has declined by more than 10 percentage points from 37.4 to 27 per cent between 2014 and 2021 (Chart 2). The World Bank is the major player here, with its share in total external debt amounting to 20.3 per cent and 14 per cent in the two years. Add on the IMF’s contributions and the figures for multilateral debt stand at 45.2 per cent and 35.3 per cent of the total respectively. Thus, despite the decline in multilateral creditor shares, their current share is quite substantial. However, the stance adopted by these institutions (backed by the US and its allies who dominate them) is that they cannot be asked to accept a haircut, notwithstanding their own culpability in the crisis. Any loss, it is argued, would affect their credit rating and therefore their ability to discharge their crucial functions.

The immediate effect of all this is that the burden of quick resolution of the crisis is falling on bilateral creditors. Since its formation, Pakistan has been a beneficiary of bilateral credit provided for strategic interests. Initially this came from the US and the institutions it controls. That explains why, despite Pakistan not meeting conditions set in most of the 13 IMF programmes which it has negotiated since 1988, it has been repeatedly favoured with new lending. Pakistan and the United States had a close relationship, especially since the mid-1980s when the Reagan administration stepped up US engagement with the Soviet Union in Afghanistan.

More recently, as the US lost confidence and interest in its operations in the region and reduced lending to Pakistan, China entered the picture. Its strategic interests made Pakistan an important ally, leading to provision of large funds, including to projects that were part of the Belt and Road initiative. As a result, while the share of bilateral loans in Pakistan’s outstanding external debt remained stagnant around 28 per cent between 2014 and 2021, the share of the Paris Club creditors declined because of “aid fatigue”, whereas that of China rose sharply (from 7.8 per cent of outstanding eternal debt in 2014 to 19.2 per cent in 2021). With lending by China directed mainly to the government, China’s share in government is 30 per cent.

If the burden of debt restructuring is to fall largely on bilateral creditors, then China would have to shoulder a very large proportion of that burden and suffer the most losses. This is not likely to be acceptable to China, for three reasons. First, although it has been a dominant bilateral lender to Pakistan over the last decade, it cannot be held solely responsible for the weaknesses that have pushed Pakistan to a situation where it is on the verge of default. Second, while China may be willing to take a hit to help Pakistan, it does not see why it must take most of the haircut, while multilaterals like the World Bank and the Asian Development Bank go scot-free. And, finally, even to the extent that it does take a cut, it does not see why it should allow the magnitude and nature of the cut to be determined in a negotiation led by the IMF and the governments that dominate it.

Given all this, it is unlikely that the IMF with its small one billion-plus contribution would be able to force an early resolution. Despite this, the IMF is choosing to use that argument to pressure the government in Pakistan into adopting policies that would only worsen rather than alleviate its problems.

(This article was originally published in the Business Line on February 20, 2023)