The first edition of the IDEAs African Network (IDAN) conference will be held from 26…

India’s Foreign Trade during the Ukraine War C. P. Chandrasekhar and Jayati Ghosh

The Russian invasion of Ukraine and the subsequent war sparked rapid and dramatic increases in some global trade prices, particularly for fuel products, wheat and fertilizer for which Russia and Ukraine are major exporters. It is now clear that these price changes were not due to actual changes in total supply, which remained largely unchanged (although source locations and trade routes shifted). Instead, market expectations amplified by media hype, financial speculation in commodity futures and simple profiteering by major fuel companies and agribusinesses, were probably the major factors. This is why these prices rose sharply from January until around June 2022, and then subsided, such that by late September, they were down to pre-Ukraine War levels.

Nevertheless, developing countries have suffered from those price rises, and not only because of the increase in the prices of these essential commodities that are universal intermediates entering into all other production and distribution costs directly or indirectly. There tends to be a ratchet effect of these prices within the developing world, as they stay high within their economies in the absence of countervailing measures by governments. The higher prices of what are essential imports for net oil-importing and food-importing countries also puts pressure on their trade balances. Meanwhile, the impact of the war and related sanctions on supply chains and disruption of trade routes can adversely affect exports.

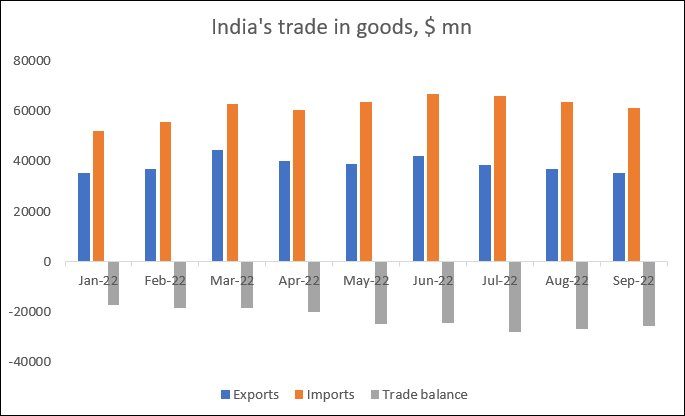

Several Indian analysts currently put forward these explanations of the Indian economy’s poor trade performance and rising trade deficits in recent months. Certainly, India’s trade has also suffered, as Figure 1 indicates, with merchandise exports mostly stagnant barring a few months, and clearly declining since June 2022. Imports by contrast have been rising and stayed relatively high over this period and have continued to increase even after global fuel prices have come down.

Figure 1

Source for Figures 1-3: RBI Bulletins, June 2022 and November 2022

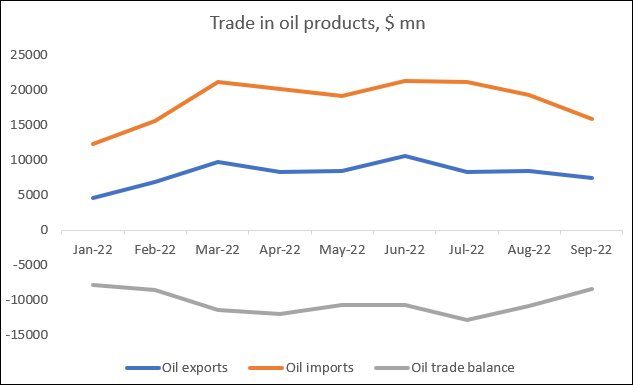

But these factors have reflected more complex trends in India’s case. To begin with, India is a net importer of oil products, but even so a significant exporter—and additionally one that has benefited from the sanctions against Russian oil exports by becoming an intermediary able to import Russian crude to provide refined petroleum to countries (including in Europe). Figure 2, which shows trade only in oil products, indicates how both imports and exports increased sharply in March 2022, dipped slightly in May and rose again in June and July. Since then, imports have fallen more than exports, such that the oil trade deficit actually declined by $2.2 billion between June and September 2022.

Figure 2

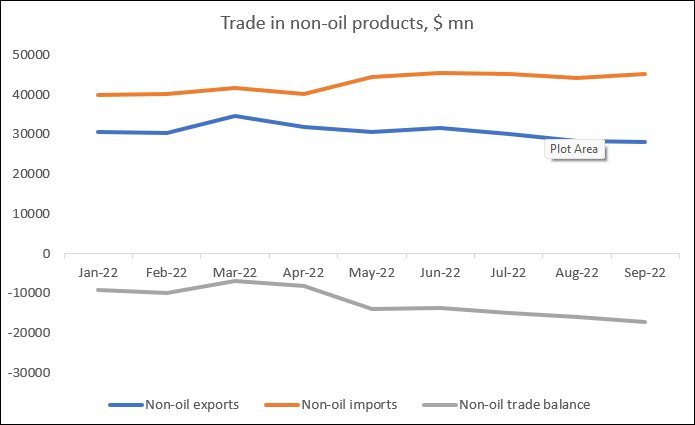

Figure 3

However, the non-oil trade balance (Figure 3) tells a different story. The non-oil trade deficit worsened from March 2022 onwards, so that in September it was $10 billion more than in March. This was not really because of rising imports, which remained broadly stable, but because exports fell continuously, going down by $6.6 billion between March and September 2022.

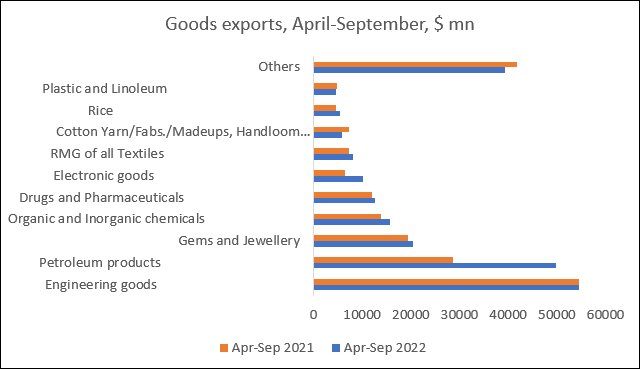

Figure 4

Source for Figures 4-5: Ministry of Trade and Commerce, GOI,

https://pib.gov.in/PressReleaseIframePage.aspx?PRID=1864921

It’s worth looking more closely at the composition of trade to see what exactly has been happening to cause this decline in merchandise exports. Figure 4 indicates that the only category of exports that showed significant increase was petroleum products, for reasons outlined earlier. But several other export categories also showed mild increase or at least stability, such as electronic goods, drugs and chemicals, gems and jewellery and readymade garments. The increase in these exports was not particularly large, and did not keep pace with the global export recovery, but even so at least these exports did not decline and even increased to some extent.

The decline in other export categories such as rice and textiles probably reflected domestic policies, with export bans and other measures designed to keep domestic prices down. For example, as domestic food price inflation increased, the government imposed bans on rice and wheat exports. The ban on non-basmati rice exports has only recently been lifted. There were demands by garment manufacturers for similar bans on textiles exports as prices of this material required for their production rose, and this appeared to be under consideration in April-May 2022. While the ban was not ultimately imposed, fears of such a ban may have affected exports. Their were also taxes imposed on the export of iron and steel.

Figure 5

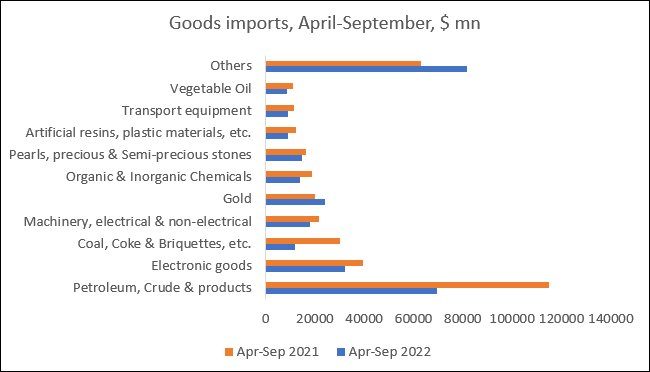

With imports, once again petroleum products dominated—but here the trend was different, as imports came down substantially in April-September 2022 compared to the same period the previous year. Interestingly, many other categories of imports also declined. Some of these declines reflect the overall depressed state of domestic demand, which has not really recovered despite all the talking up by official and interested parties.

But there was a significant increase in the “other” or miscellaneous category of imports, as well as in gold imports. India has been a “sink for precious metals” for a very long time, as gold continues to be seen as a safe investment or form or saving in times of uncertainty.

Ultimately, these trade patterns suggest that the increasing merchandise trade deficits in India cannot be blamed on external or global factors. They are likely much more the result of domestic economic tendencies, and therefore should be of greater concern for policy makers.

(This article was originally published in the Business Line on December 12, 2022)