Donald Trump’s top economic advisor claims the President has weaponised tariffs to ‘persuade’ other nations…

Will the GST Regime Fail? C. P. Chandrasekhar and Jayati Ghosh

On August 10, the central government, in a rare gesture of magnanimity, released Rs 1,16,665.75 crore, which was the estimated equivalent of two instalments (as opposed to one) of sharable taxes it must release to the states. It claimed that it had (in its ‘generosity’) doubled the “normal” monthly devolution of Rs 58,332.86 crore.

This gesture was not without motive. July marked the first month after the termination of the practice of compensating states for shortfalls in accruals from imposts that had been subsumed under the Goods and Services Tax (GST), relative to a sum reflecting a 14 per cent annual increase starting 2015-16 in revenues. It was this compensation to protect revenues, promised to state governments ceding their constitutional right to impose separate indirect taxes, that had persuaded them to accept the new regime. However, neither was there any clear specification of what the base year values were for individual states and all states and union territories put together, or whether the growth rate mentioned was a compounded rate starting 2015-16. Such matters were glossed over in the rush to implement the new regime.

In the original agreement the compensation was assured for five years, with transfers backed by a fund built using a time-bound compensation cess imposed by the centre on a set of luxuries. The temporal nature of the assurance implicitly assumed that by the end of the 5-year period the success of the new tax regime would have taken revenues from the taxes concerned to levels that at the minimum would reflect the promised 14 per cent annual increase. Only in the interim, if at all, would compensation have to be delivered, which it would irrespective of circumstances.

In practice, revenues from the new taxes were far less buoyant. Estimates vary, but one from two economists at the Indian Institute of Management, Indore suggests that by 2018-19, well before the pandemic struck, the compound annual rate of growth of revenues of the states since 2015-16, through state-level and integrated imposts under GST, was only around 4.5 per cent. So, states had to be compensated. When the COVID-19 pandemic squeezed revenues at both the central and state levels in 2020-21, the shortfall widened and the collections from the compensation cess fell short of the required transfers.

Reneging on its promise, the Centre declared that since the revenue shortfall reflected not just the effects of the ‘implementation’ of the GST system but an ‘Act of God’ in the form of the pandemic, it would be responsible for only that part of the shortfall attributable to the GST regime per se. It reluctantly agreed to cover the rest of the transfer due to the states, with market borrowing incurred on their behalf, with the interest and amortisation payments due on that borrowing being met from future accruals to the compensation fund backed by the compensation cess.

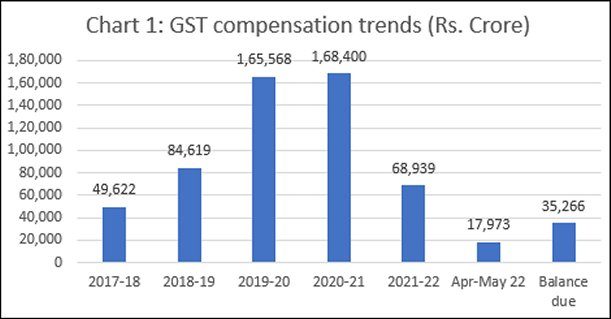

According to data annexed to a written reply to a question in the Rajya Sabha by the Minister of State for Finance Pankaj Chaudhary on July 19, 2022, GST compensation released by the Centre to the States and Union Territories rose from Rs. 49,622 crore in 2017-18 to Rs. 84,619 crore in 2018-9 and Rs. 1,65, 568 crore in 2019-20. The figure stagnated at Rs. 1,68,400 crore in 2020-21 because of the decision of the Centre to hold back on transfers, choosing instead to ‘compensate’ states with borrowing to the tune of Rs. 1,10,000 crore. Surprisingly, even as a feeble recovery from the pandemic-year recession began in 2021-22, the Centre’s compensation fell to Rs. 86,912 crore for the period stretching from April 2021 to May 2022 (Chart 1), supplemented with receipts from enhanced borrowing to the tune of Rs. 1,59,000 crore. The Centre expects to pay out another Rs. 35,266 crore for June 2022, the last month for which compensation was due as per the original agreement.

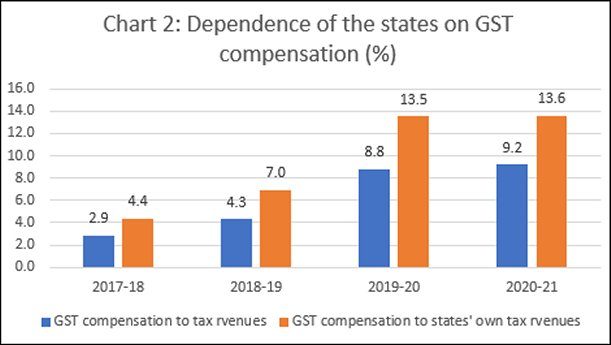

What is telling here is the dependence of the states on compensatory transfers for revenues. The actual GST compensation received by the states rose from 2.9 per cent of their tax revenues in 2017-18 to 4.3 per cent in 2018-19, and then jumped to 8.8 and 9.2 per cent respectively in 2019-20 and 2020-21 (Chart 2). Relative to the states’ own tax revenues the corresponding figures were 4.4 per cent in 2017-18, 7 per cent in 2018-19, 13.5 per cent in 2019-20 and 13.6 per cent in 2020-21. What is noteworthy here is that the spike in dependence on GST compensation occurred in 2019-20, which was a pre-pandemic year. This should have risen sharply in the next year as well, when state revenues fell following the pandemic-induced collapse in economic activity. It did not rise further only because of the government’s decision to hold back on compensation payments based on the ‘Act of God’ principle. The revised estimates for revenue receipts for all states together for 2021-22 have yet to be officially collated, so the most recent trend is not clear.

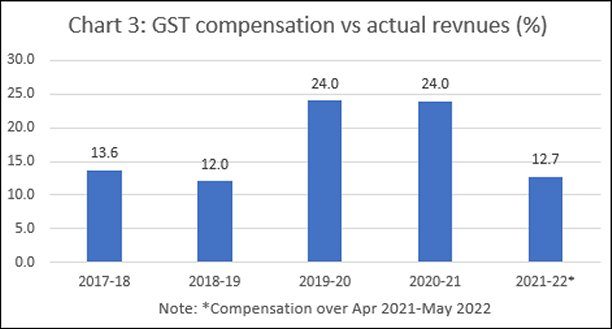

However, if we examine the ratio of GST compensation to GST revenues accruing to the states, the figure fell from a much higher 13.6 per cent in 2017-18 to just 12 per cent in 2018-19, before rising to 24 per cent in both 2019-20 and 2020-21. But counting the compensation paid for the 14-month period April 2021 to May 2022, the figure stood at 12.7 per cent relative GST receipts in 2021-22 (Chart 3). By using the borrowing route, the Centre had clearly been reducing its own compensatory commitment to the states. The decline in 2021-22 is not because of an increase in GST revenues accruing to the states, with preliminary estimates for all major states suggesting that those revenues actually fell (from Rs. 7.02 lakh crore to Rs. 6.84 lakh crore). It was just that the compensation paid to the states fell even more (from Rs. 1.68 lakh crore in 2020-21 to Rs. Just 86,912 crore for April 2021 to June 2022), for reasons that are unstated.

It should be clear from these trends that if five years with the GST is any indication, it has been a failure relative to the promise with which it was introduced. With the practice of compensating the states for a revenue shortfall coming to an end in June, the states face the prospect of a sharp squeeze in their revenue base as a result of their accession to the GST regime. Many states have demanded that the compensation cess and scheme of compensating the states be extended for another five years. The Centre, ignoring the absence of consensus on the matter in the GST Council, has in effect turned down the request of the states. But it has indeed extended the period for which the compensation cess will be imposed, to garner the revenues needed to meet the servicing costs of the debt it took to compensate the states during the two pandemic years 2020-21 and 2021-22, in order to reduce the draft on its own resources.

Meanwhile, a crisis is brewing, with the enhanced fiscal pressure forcing states whose governments are not politically subordinate to the party in power at the Centre to rethink their participation in the failed GST regime. They are likely to be emboldened by the fact that the Supreme Court has held that the decisions of the GST Council are not binding on state governments, that can choose their own tax composition and rates. If that happens, the GST failure will be complete.

(This article was originally published in the Business Line on August 22, 2022)