The Global Conference Towards a needed Paradigm Shift in Economic Policy: Addressing Industrial Development and…

Are Global Commodity Prices Responsible for the Current Crises in Emerging Markets? C. P. Chandrasekhar and Jayati Ghosh

The ongoing political and economic turmoil in Sri Lanka is clearly the worst crisis the country has faced since its Independence. Yet while Sri Lanka’s current difficulties are clearly extreme, it is by no means alone among developing countries, several others of which are close to tipping point. This depressing prognosis is now widely acknowledged, even among the international financial institutions, and financial markets are probably bracing themselves for the next round of significant defaults by governments and private borrowers in different parts of the world.

Yet, while the severity of the problem is recognized, most analysts persist in attributing the blame for the current external difficulties of many developing countries entirely to the war in Ukraine, which sharply drove up commodity prices, especially for grain and oil. This is only partly true and leaves out some deeper and more fundamental causes of the emerging crises. These deeper causes are probably not mentioned because they would call into question the basic policy paradigm that has been peddled by mainstream advisors and the international financial institutions for several decades now.

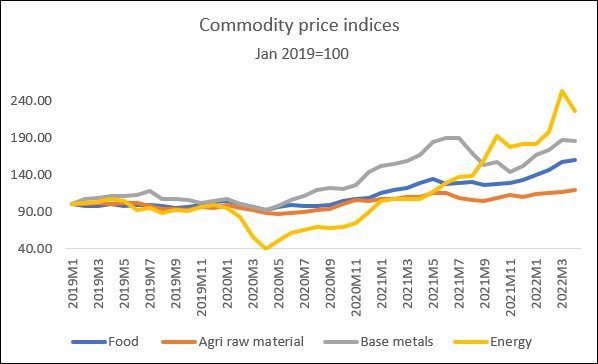

Figure 1

Source: IMF commodity price database

Of course, it is true that food and fuel price increases have wreaked a lot of damage, and generated inflationary pressures in many economies that have not yet even recovered from the impact of the Covid-19 pandemic and where employment levels are still down. Figure 1 shows that by April 2022, the energy price index was nearly 6 times higher than its most recent trough of April 2020. But prices had been rising well before the Ukraine War; and the most recent price increases were not driven by supply constraints, but by profiteering by major oil companies and speculation in oil futures.

The food price index had also started increasing before the Ukraine War, though the increase accelerated after the Russian invasion. Here too, a significant role has been played by financial speculation especially in wheat futures, rather than in supply shortages per se. Figure 2 also suggests that the price increases for agricultural raw materials have been much more muted, while the price index for base metals has been quite volatile and shown lower increases than for energy. This suggests that countries that are commodity exporters would not have gained that much over this period.

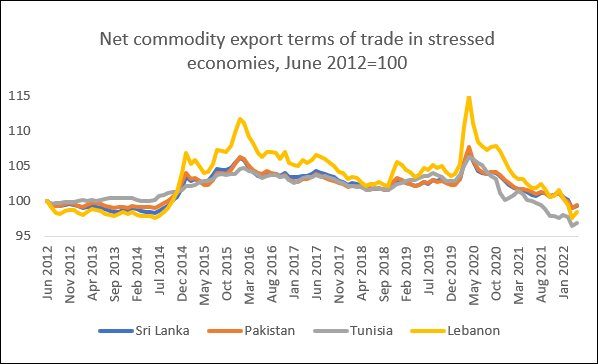

However, farmers across the world have definitely lost out, because of the growing gap between the prices of agricultural output and fertilizer, as shown in Figure 2. The dramatic increase in fertilizer prices is clearly a result of the Ukraine War. Russia, previously the world’s largest exporter of fertilizer, suspended these exports in March 2022 and subsequently imposed quotas in exports that reduced global supply. As a consequence, farmers across the world and especially in low and middle income countries, found it harder to access this crucial input, which could result in higher costs and lower yields in agriculture.

Figure 2

Source: IMF commodity price database

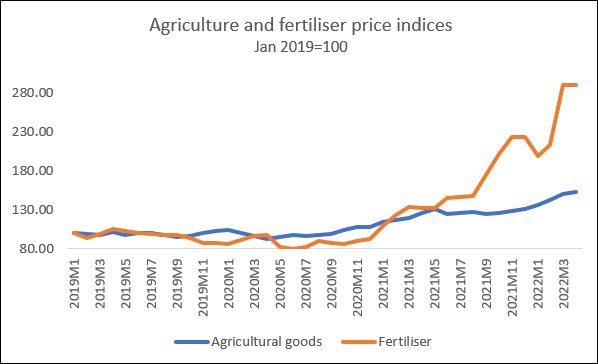

Even so, the current debt problems of so many developing countries cannot be blamed on these higher prices. Consider some of the countries that are currently seen as having the most extreme balance of payments stress, which are all in default or very close to default currently: Sri Lanka, Lebanon, Pakistan and Tunisia. Figure 3 provides data on the net export terms of trade for these four countries over the past decade. This is an index of the prices of net exports, in terms of a basket of commodities weighted by the ratios of exports/imports to GDP.

Figure 3 definitely indicates a rapid and significant decline in the terms of trade for all four countries between May 2020 and April 2022. Even so, the current levels, while low, are not that much lower than the levels of 2012-14, when all of these economies were seen to be doing well and certainly did not face significant external difficulties.

Figure 3

Source: IMF Commodity terms of trade database

So the causes of the current crisis have to be sought elsewhere. The past decade of incredibly low interest rates in the advanced economies encouraged much more borrowing all over the world, with “cheap” money created in the North also flowing increasingly to “emerging” and “frontier” markets, especially in the form of new debt in credit and bond issues. Many LMICs experienced significant increases in external borrowing by both public and private agents. For example, the share of commercial borrowing in Sri Lanka’s external debt went up from less than 4 per cent in 2004 to 58 per cent in 2019, most of it in the form of International Sovereign Bonds. Such strategies were actively encouraged and even cheered on by the IFIs and the Davos crowd.

This was always a problematic process, given the monetary hierarchies in the global economy and the fact that capital leaves LMICs much more quickly at the first sign of any problem. But then, LMICs were much more battered economically by the Covid-19 pandemic than the rich countries. Advanced economies were able to provide massive countercyclical measures, especially significantly increased fiscal spending, because financial markets effectively allowed and even encouraged them to do so. By contrast, LMICs faced significant declines in export and tourism revenues, tighter balance of payments constraints, greater difficulties in accessing much more volatile external capital. They were prevented from increasing fiscal spending by much because of those same financial markets, because of debt overhang and potential capital flight. As a result, their economic recovery was much more muted and economic conditions remain mostly dire. Then the Ukraine war and related profiteering by big corporations, made matters much worse especially for food- and fuel-importing countries, by generating inflation.

The half-hearted attempts at debt relief like the moratorium on debt servicing in the first part of the pandemic only postponed the problem, pushing the can (of worms) down the road and allowing the can to get bigger as it rolled. There has been no meaningful debt restructuring at all, even though it is absolutely essential. The IMF and World Bank bewail the situation but have done next to nothing to help, and have even added to the problem through their own rigid insistence on repayments and the appalling system of surcharges imposed by the IMF.

Those who helped to create the massive hole so many developing countries now find themselves in, are missing in action when help is required to extricate them.

(This article was originally published in the Business Line on July 11, 2022)