The weaponization of tariffs by US President Donald Trump has clearly generated fear and loathing…

The Forex Bonanza C. P. Chandrasekhar and Jayati Ghosh

On 16 July 2021 India’s foreign exchange reserves stood at $612.7 billion. That was almost 30 per cent higher than its level of $475.6 billion at the end of March 2020, when the effects of the pandemic began to be felt. It also reflected a $95 billion increase from the level of reserves a year earlier and a $35.7 billion rise over the level touched at the end of financial year 2020-21. This evidence, which could be construed as a sign of resilience in a time of crisis, is, however, no cause for celebration. Rather it points to effects of the economic contraction induced by the pandemic and the new vulnerabilities that the circumstances accompanying the pandemic have generated.

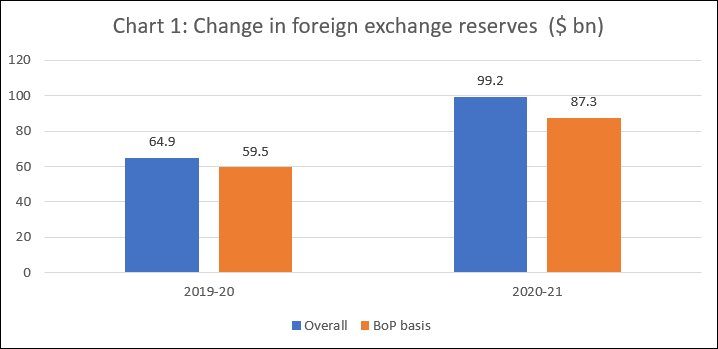

Data recently released by the Reserve Bank of India show that India’s foreign exchange reserves position improved by $99.2 billion in financial year 2020-21 as compared with $64.9 billion in 2019-20. On a balance of payments basis, or after adjusting for valuation changes (mainly appreciation of the relative value of the US dollar), the respective figures were $87.3 billion and $59.5 billion (Chart 1).

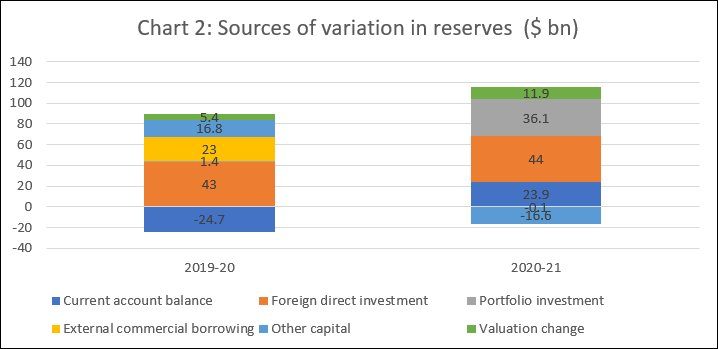

The increase in the volume of foreign reserves in pre-pandemic year 2019-20 occurred despite the current account reflecting a deficit of $24.7 billion, mainly due to a deficit in merchandise trade driven by large imports. If yet reserves rose, it was because inflows of capital from abroad were far in excess of that required to finance the current account deficit, with (net) foreign direct investment inflows of $43 billion, external commercial borrowing of $23 billion, and other capital inflows of close to $17 billion (Chart 2). On the other hand, net portfolio capital inflows amounted to a marginal $1.4 billion. With the above net inflows on account of commercial borrowing and portfolio investment adequate to finance the current account deficit, the large flows on account of FDI and other capital inflows (totalling $60 billion) contributed to the observed increase in reserves. India was building its reserve by increasing its external liabilities.

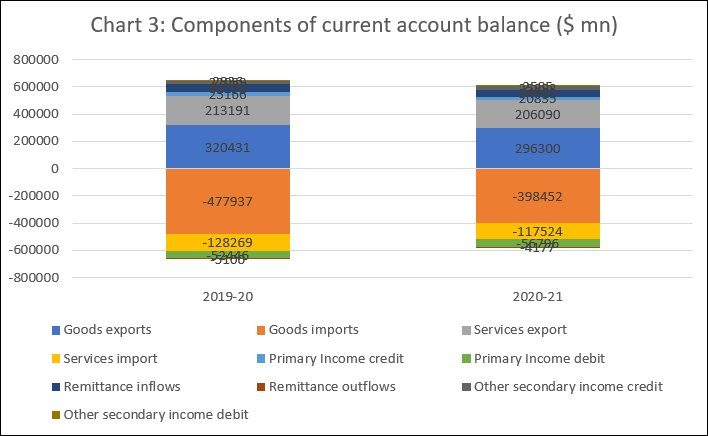

In two senses, the scenario in Covid year 2020-21 differed from this picture in 2019-20. First, the current account which was chronically in deficit, was marked by a net a surplus in 2020-21. This was essentially because the contraction-induced decline in the dollar value of India’s imports (from $478 billion in 2019-20 to $398.5 billion in 2020-21) was much larger than the fall in her exports (from $320 billion to $296 billion) triggered by the pandemic-induced contraction in global economic activity (Chart 3). A fall in the price of oil partly contributed to the decline in the import bill in the early part of 2020-21, but that trend was quickly reversed. While the price of Brent crude more than halved from its close to $50 a barrel level during March and April 2020, it subsequently rose, regained its early-March level by mid-August and then went on to touch a peak close to $70 in early March 2021. Thus, the fall in India’s import bill over the financial year 2020-21 as a whole was largely the result of a fall in the volume of goods imports as a result of combination of restricted supply and a recession in demand.

The second significant difference between developments in financial years 2019-20 and 2020-21 was a reversal in the volume of capital inflows. Foreign direct investment inflows remained more or less the same at $43 billion and $44 billion respectively in the two years. But net inflows on account of external commercial borrowing and other capital movements, which amounted to $23 billion and $17 billion respectively in 2019-20, turned negative in 2020-21. There was, however, a marginal outflow in the case of commercial borrowing, but a significant outflow of $17 billion in the case of “other capital” movements, mainly banking capital. If these latter trends did not neutralise the effects of the surplus on the current account, it was because portfolio investment flows rose from just $1.4 billion in 2019-20 to $36.1 billion in 2020-21.

When the effects of the pandemic were first felt, there was an outflow of portfolio investments from most emerging markets including India. But the response to the economic crisis induced by the pandemic in the advanced economies included an intensification of quantitative easing, or the infusion of large volumes of cheap liquidity into the system. The search for yields this set off among investors with access to that cheap capital soon triggered a spike in portfolio investments in emerging markets. India was a beneficiary of that spike, with large inflows of portfolio capital, leading to the rapid build up of foreign exchange reserves.

Thus, a combination of factors account for India’s strength on the external front as reflected in its foreign exchange reserves, which are now the third largest in Asia after China and Japan. One is the surplus on the current account of the balance of payments. But that is a reflection of the recession and output contraction accompanying the pre- and post-Covid crises. Thus, any increase in the level of reserves resulting from this factor is more a reflection of weakness rather than of strength.

The other important contributor is capital inflow. But reserves accumulated through such flows are not available to the central bank without any commitment of associated payments or capital repayment. The IMF defines reserves as external assets that are readily available to and controlled by monetary authorities for direct financing of external payments imbalances, for indirectly regulating the magnitudes of such imbalances through intervention in exchange markets to affect the currency exchange rate, and/or for other purposes. India’s reserves were not of that kind. They are pre-committed, and therefore are not readily available because the central bank may need to access those assets at short notice to meet those commitments. What this implies is that any increase in reserves resulting from such inflows are borrowed reserves and not reserves earned, as through positive net exports for example.

In sum, the sudden and sharp spike in India’s foreign exchange reserves in recent months is the result of recessionary conditions and the speculative rush of investors riding on cheap capital into Indian equity and debt markets in search of quick and high yields. It can hardly be a cause for comfort, let alone celebration.

(This article was originally published in the Business Line on July 26, 2021)