Donald Trump’s tariffs have disrupted supply chains, roiled global markets, and escalated the trade war…

When the US and India Together Failed the Developing World C. P. Chandrasekhar and Jayati Ghosh

At the recent G20 and IMF-WB Spring meetings held virtually in the third week of April 2020, a proposal for the IMF to issue an additional 500 billion of SDRs was blocked by the United States and – astonishingly – by India. In the wake of the Covid-19 pandemic and the unprecedented collapse of global economic activity, there had been many calls for the IMF to issue at least 1 trillion SDRs. This would be particularly important for all developing countries, since they are currently facing the brunt of the collapse in world trade and tourism, as well as sharp reversals in capital flows, which have caused their currencies to depreciate and led to serious problems in servicing their external debts.

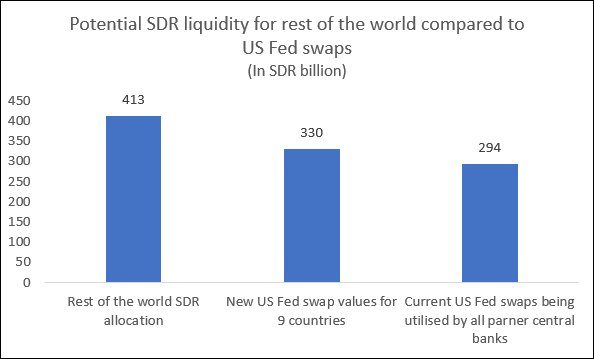

In the context, the proposal for the immediate issue of 500 billion SDRs may seem to be inadequate, but it would still have been a significant increase in global liquidity, because the global “flight to safety” in financial markets has given rise to dollar shortage. At the moment this is being met for a few countries by US Federal Reserve swap lines.

What’s the difference? The Fed’s swap arrangements are aimed at providing central banks in partner countries access to dollars to meet demands in their jurisdictions. Since October 31, 2013, temporary swap agreements with a selected few central banks—the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, and the Swiss National Bank—were converted into standing arrangements that are open-ended, both in terms of amount and time period, but have been significantly used in the recent period. On 17 March, the US Fed put in place new six-month (extendable) swap lines of $60 billion each for central banks in Australia, Brazil, South Korea, Mexico, Singapore, and Sweden, and $30 billion each for Denmark, Norway, and New Zealand, totalling $450 bn. At present, around $400 bn of such swap lines are being used. But these go to only a select group of countries, favoured by the US government. Most countries cannot access them, especially the developing countries who may need it the most.

By contrast, SDRs are supplementary reserve assets (determined as a weighted basket of five major currencies) issued by the IMF to all member countries. The IMF’s Articles of Agreement specify that “general allocations of SDRs should meet a long-term global need to supplement existing reserve assets in a manner that will promote the attainment of the IMF’s purposes and avoid economic stagnation and deflation, as well as excess demand and inflation”. The IMF has the power to create this additional international liquidity at no extra cost, and new allocations are NOT in the form of debt. Since a fresh issue of SDRs must be distributed according to each country’s quota in the IMF, it cannot be discretionary and (unlike other loans by the IMF) cannot be subject to other kinds of conditionality or political pressure. One trillion SDRs (which could very easily be created and distributed) would have significant impact in ensuring that global international economic transactions simply do not seize up even after the lockdowns are lifted, and that developing countries in particular are able to engage in international trade. But even 500 billion new SDRs would have some effect, particularly for developing countries for whom this can be a liquidity lifeline in very difficult times.

The proposal to the IMF was a modest one, providing only 413 bn of new SDRs to the world other than US. As Figure 1 shows, this is not very much more than the new swap lines created by the US Fed for only 9 countries last month, or the amount of US Fed swap lines currently being actively utilised (which is only a small part of what is available to be drawn upon).

Figure 1: The 500 bn SDR increase would have been small relative to US swap lines

The US has argued that this would not mean much for developing countries since they would get only a small share of the new allocation. It is true that developing countries would have received only a small proportion of this total, since their quotas in the IMF tend to be small, even minuscule. Despite this, they would still have benefited substantially from this limited 500 billion issue. 102 countries have thus far approached the IMF for emergency balance of payments assistance, and most of them are in dire straits to meet immediate foreign exchange payments. Even the relatively small amounts they would receive would make a huge difference in terms of their current requirements. (Obviously, for more significant resources to deal adequately with the pandemic and the economic fallout, much more would be required, say 3 to 4 times that amount.)

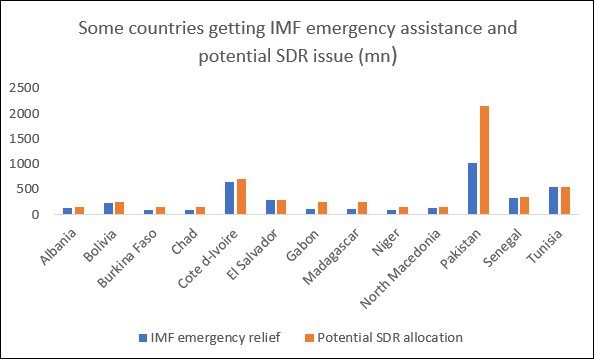

To see why even this SDR 500 bn would make a difference, consider the 25 countries that have received emergency assistance this month under the IMF’s existing financing arrangements, as well as the Rapid Credit Facility (RCF), Rapid Financing Instrument (RFI), and debt relief grants financed by the Catastrophe Containment and Relief Trust (CCRT). The total amount of such assistance comes to SDR 5.54 billion. But if the 500 bn SDR allocation had been approved, these countries would have also received SDR 10.76 billion – nearly twice the amount! Furthermore, unlike the IMF’s emergency loans that would require repayment with interest, SDR allocation requires neither.

Figure 2 examines the case of some of the countries that have received the largest amounts of this recent emergency assistance (above SDR 90 million). In almost all cases, the SDR allocation would have provided more resources than the emergency loans, and provided it in a non-debt and non-conditional form. Since it is generally recognised that the amounts disbursed under the loans are far too small relative to the needs, any means to adding to it—especially such a painless method as the SDR increase—would be eminently desirable.

Figure 2: SDR allocation would have provided more resources to countries currently getting emergency IMF assistance

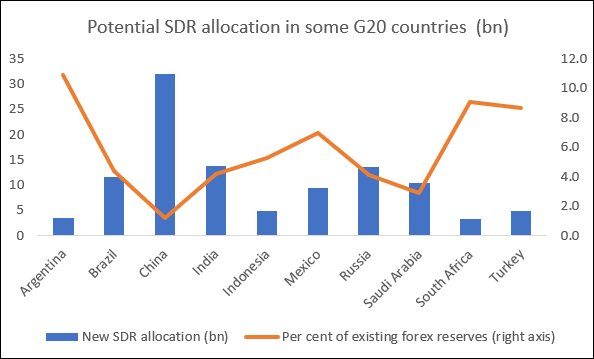

Figure 3: Even G20 countries would benefit

What is more, even the larger developing countries such as the members of G20 would have benefited from this. Figure 3 shows that, other than countries with very large foreign exchange reserves like China and Saudi Arabia, the other G20 emerging markets would add non-negligible amounts to their external reserves, at a time when collapsing export revenues, capital flight and rising external debt payments have made such reserves particularly important.

So why would the Government of India veto such a sensible and necessary proposal? The possibilities range from petty regional politics to attempts to placate the Trump administration so as to access the US Fed’s exchange swaps. Whatever the reason, India has betrayed the rest of the developing world and sided with the US and allies that dominate the world.

(This article was originally published in the Business Line on April 21, 2020)