Donald Trump’s top economic advisor claims the President has weaponised tariffs to ‘persuade’ other nations…

The Crisis in Manufacturing C. P. Chandrasekhar and Jayati Ghosh

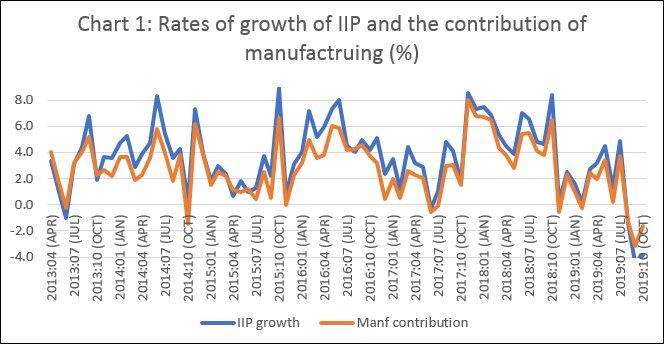

With the Index of Industrial Production (IIP) registering negative month-on-month annual rates of growth over the three months ending October 2019, the perception, based on trends in individual industries, that Indian industry is experiencing or is on the road to a recession has gained strength. It is true that month-on-month growth rates tend to be volatile and are heavily influenced by the base effect. However, trends depicted in Chart 1 suggest that growth decelerated sharply for some recent months before turning negative. Moreover, even the growth of 0.5 per cent during the first seven months of this financial year (April to October) relative to the corresponding period of the previous year points to medium-term stagnation, from which trajectory growth has moved into negative territory.

Chart 1 also shows the contribution made by manufacturing to changes in the overall index, computed as the change in the overall index resulting from changes in the manufacturing IIP alone, after accounting for the weight of manufacturing in the overall index. (The change in the manufacturing index in any month relative to that index in the corresponding month of the previous year is multiplied by the weight of manufacturing in the overall index and then divided by the aggregate IIP in the base year.) The IIP is predominantly driven by changes in the index for manufacturing, because of lower weights for electricity, gas and water supply. As is widely acknowledged, movements in the IIP reflect trends in in the registered manufacturing sector, since coverage of the index is restricted almost solely to registered firms. So, the negative growth in that index in recent months suggests that the crisis that has afflicted agriculture for some time and had overwhelmed the informal and unorganised manufacturing sector in the aftermath of demonetisation, has now spread to the corporate sector.

Analyses of the current industrial slowdown have emphasised the role of demand factors in driving the downturn. Defaults on large loans provided to corporate houses during the credit surge that began in the mid-2000s, the failure of medium and small businesses adversely affected by demonetisation to meet their debt servicing commitments, and a crisis in the non-bank financial sector overexposed to an unsustainable boom in housing, real estate and automobile markets, have combined to cut off credit flow and shrink the demand that it fuelled. Meanwhile, government expenditure has contracted because of falling revenue growth and an obsessive commitment to a conservative fiscal stance, weakening another important stimulus to growth. The resulting growth slowdown has further worsened the situation, by increasing the probability of default and adversely affecting the revenues mobilised and expenditures undertaken by central and state governments.

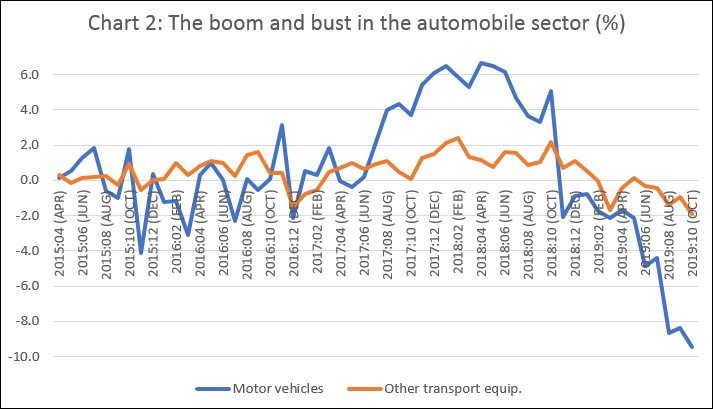

With this combination of factors dampening demand, the crisis in the manufacturing sector is proving to be generalised. Initially, with the credit pipe getting clogged because of accumulating NPAs, the crisis was most visible in sectors like automobiles and real estate, which depend heavily on debt-financed demand. Chart 2 shows the extent to which the overall industrial slowdown was the result of a deceleration of growth in the automobile sector (with its contribution calculated in the same manner done for manufacturing above).

There are three features of note in the contribution of these sectors to the overall movements of the IIP. First, changes in motor vehicles production dominate the influence of this sector on movements in the overall index of industrial production, with ‘other transport equipment’ playing a much smaller role. Second, the contribution of the motor vehicles product group to overall changes in the IIP (both during periods of boom and periods of deceleration) is substantial, varying between a positive 7 per cent and a negative 9 per cent. Finally, before the recent deceleration and subsequent negative growth of the motor vehicles group, that sector had contributed hugely to an acceleration in industrial growth as captured by the IIP. That boom seems to have occurred in the immediate aftermath of demonetisation, starting around the middle of 2017 and lasting for more than a year, before the slump began.

This boom-bust cycle following demonetisation could possibly be the result of changes in bank lending behaviour. Demonetisation resulted in a large increase in bank deposits, when citizens were required to deposit all notified “high value notes” with banks, but could only take out a limited amount by way of new notes. Since lending to industry and infrastructure was already excessive and there were clear signs of mounting NPAs, banks possibly turned to retail lending, in which automobiles is the second most important component after housing, as well as lending to NBFCs. This possibly triggered the post-demonetisation boom (delaying the full realisation of the measure’s adverse effect) till overexposure and a tighter credit environment shrunk credit to that sector, squeezing demand. This has now gone to an extent where the motor vehicles group is a dominant driver of the industrial slowdown.

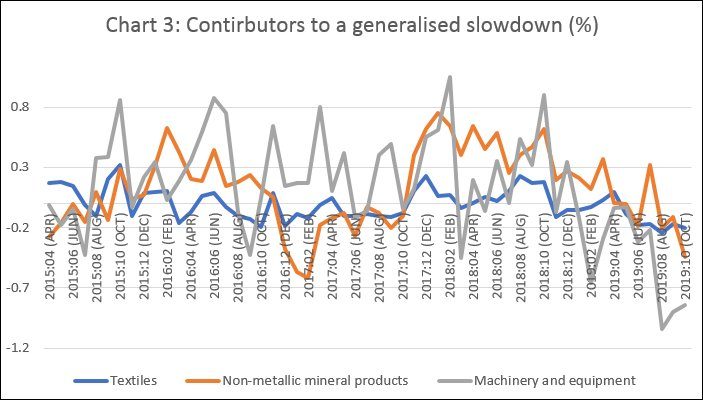

While trends in automobiles point to the important role that credit has played in both driving growth and unleashing recessionary trends, the evidence elsewhere points to the industrial slowdown being more generalised and being affected by factors other than credit. Chart 3 tracks the contribution of three varied sectors (Textiles, Non-metallic mineral products and Machinery and equipment) with significant weight in the IIP, to the overall change in the index. What emerges is that all these sectors have contributed to the negative growth in recent months. The contribution of textiles to overall growth has been low in general, but it too shows similar movements in terms of contribution as the other two sectors. The largest contribution to the declines in growth is from Machinery and equipment, followed by Non-metallic mineral products. Interestingly, the Machinery and equipment sector too appears to have gone through the boom-bust cycle seen in the case of automobiles (and possibly real estate). This is unlikely to be the direct effect of credit, but because of the cyclical movement in the derived demand for this sector.

Overall, the generalised nature of the recession suggests that other factors, such as the contraction in public spending, have now kicked in as factors slowing demand and industrial growth, thereby intensifying the crisis.

(This article was originally published in the Business Line on December 17, 2019)