The weaponization of tariffs by US President Donald Trump has clearly generated fear and loathing…

The Skewed Structure of India’s Bond Market C. P. Chandrasekhar and Jayati Ghosh

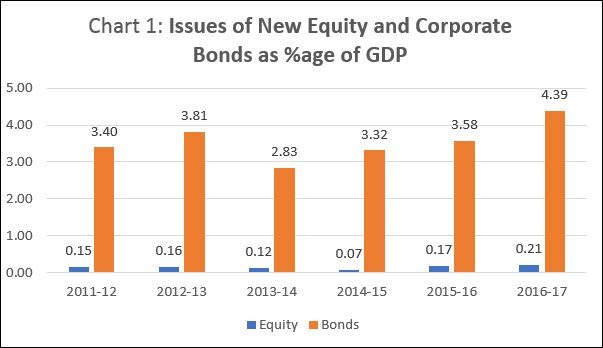

India’s efforts to activate its corporate debt market, not least by periodically raising the ceiling on investment by foreign portfolio investors in corporate bonds, are yet to succeed. Mobilisation of capital through the issue of corporate bonds has just about crept up to 4.4 per cent of GDP (Chart 1). Though that is much larger than the 0.2 per cent of GDP for mobilisation through new equity issues, it is way short of the figure (varying from 15 to 50 per cent) for most similarly placed emerging markets. Relative to the size of its economy, India’s corporate bond market is undoubtedly small. This is the case even though in recent years large flows of household savings away from deposits to mutual funds has increased the flow of investments into debt funds, which allocated resources to corporate bonds as well. In many instances, savers are influenced by intermediaries to take on risks they do not understand.

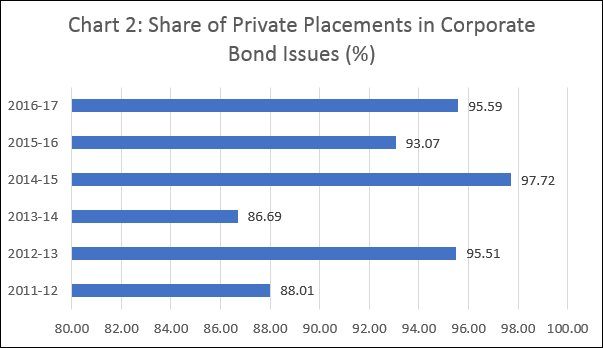

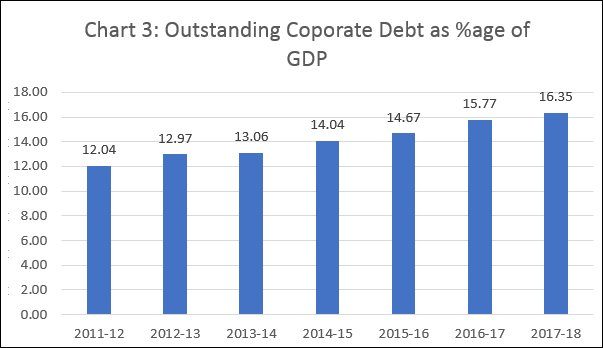

Moreover, the market seems to be one in which arms-length sales are the exception rather than the rule. Much of the corporate bond sales in India occur through the private placement route, with the share of such issues in the total standing at around 95 per cent in recent years (Chart 2). Overall, the accumulated value of outstanding corporate bonds stood at 16.3 per cent of GDP at the end of March 2018 (Chart 3), whereas that ratio for government securities was around 33 per cent and general government debt is placed at close to 70 per cent of GDP. Even the ownership of government securities is skewed, with commercial banks accounting for 40 per cent and insurance companies and provident funds for another 29 per cent.

Clearly, in the risk-return calculations that ordinary savers and specialised financial institutions like insurance companies and pension funds are making, corporate debt has failed to qualify as a large target. The absence of a corporate bond market is more of a problem since the government, based on the recommendations of the Narasimham Committee decided to close down the major development finance institutions (such as IDBI, IFCI and ICICI) by converting them into commercial banks, which do not have the benefit of special funding either from the budget or the Reserve Bank of India.

This in essence means that the predominantly bank-based financial system is backed with relatively short term deposits as capital. Using that to finance capital intensive investments or long gestation projects would involve liquidity and maturity mismatches that can lead to fragility. This is precisely what happened, as the government cajoled publicly owned banks to lend for large corporate investments, resulting in mega-sized debt defaults.

Bank exposure is not just directly to corporates, as the yet unfolding IL&FS sags reveals. It is now clear that banks also invest in bonds issued by the non-bank financial companies, which in turn use that capital to lend to business of various kinds. Given the structure of this activity, NBFCs need to constantly roll-over debt to sustain their operations and meet their own payments commitments. When a large player like IL&FS defaults on debt, the flow of credit to the rest of the non-bank financial sector tightens, resulting in “liquidity” problems that can precipitate collateral default and increase the risk of more systemic effects.

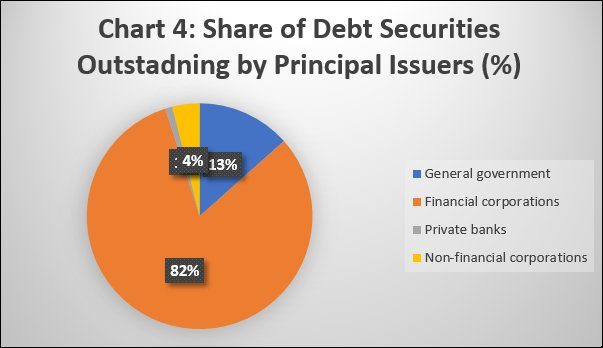

The danger here could be that while the corporate bond market may not be too active, the bond market involving financial intermediaries could be on the rise. Capital mobilised by bond issues by financial intermediaries could be used to finance lending to corporations and businesses. According to data from the debt securities database of the Bank for International Settlements, in the distribution of outstanding debt securities issued by the principal sources, the share of financial corporations stood at 82 per cent, as compared with 13.4 per cent for general government, and 4 per cent for non-financial corporations (Chart 4).

If this fragile structure results in the tightening of credit flow domestically, another possibility is that Indian corporations would turn to international borrowing, attracted by the currently low interest rates in foreign markets. Since the effort at keeping the cost of capital down may encourage many of the borrowers not to hedge adequately against foreign exchange risk, they can be hit adversely by external circumstances other than merely the business environment. Currency depreciation can increase the rupee cost of servicing these loans, and that additional burden can force default when business conditions deteriorate even marginally.

In sum, debt market conditions are such that the financing of corporate investment, especially industrial investment, should rely on specialised institutions that fill the gap created by absent long-term financing at reasonable interest rates. It is for this reason that almost all late industrialising market economies established development finance institutions owned or sponsored and supported by the state. Even emerging market countries that have gone in for financial liberalisation have retained these institutions, whose role has often been enhanced.

That evidence, and India’s own unsatisfactory experience with trying to foster a corporate bond markets, strengthen the view that transforming the development finance institutions into commercial banks was a blunder. Before non-performing assets and NBFC failures threaten a systemic crisis, it may be best for the government to re-establish the development finance architecture.

(This article was originally published in the Business Line on February 11, 2019.)