The weaponization of tariffs by US President Donald Trump has clearly generated fear and loathing…

Remittances as Saviour C. P. Chandrasekhar and Jayati Ghosh

Once again, the World Bank has released a Brief declaring India to be the largest recipient of remittances from abroad. According to the Bank, remittances to India that totaled $65 billion in 2017, are likely to touch $80 billion this year, way ahead of China, the second largest recipient with $67 billion. The rise is in keeping with longer term trends, despite short periods when it appeared that remittance volumes were on the decline.

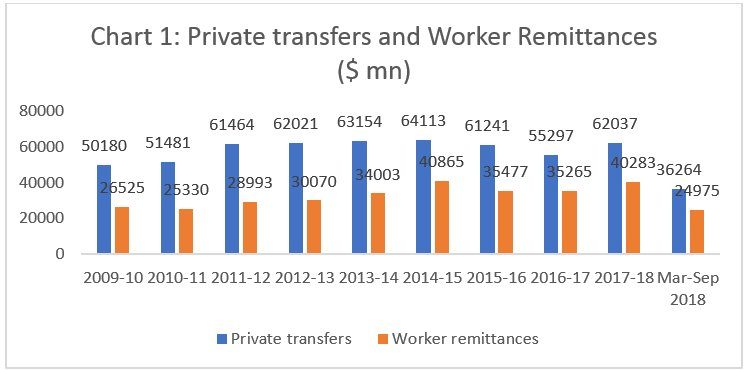

Official Indian balance of payments data provide information on private transfers (which include (i) remittances for family maintenance, (ii) local withdrawals from Non-Resident Rupee Accounts (NRE and NRO), (iii) gold and silver brought through passenger baggage, and (iv) personal gifts/ donations to charitable/religious institutions) Workers’ remittances (which consist only of transfers made by migrants employed and resident abroad to relatives in India) form the dominant component of private transfers.). The share of workers’ remittances in total transfers, which fell from 53 per cent in 2009-10 to 47 per cent in 2011-12, has since risen almost consistently (barring a dip in 2015-16) to touch a high of 69 per cent in the first six months of financial year 2018-19.

Chart 1 shows that in the years after the global financial crisis, private transfers and remittances (especially the latter) appeared to have peaked in 2014-15 and then (in tandem with falling oil prices) were in decline till 2016-17. That trend reversed in 2017-18. Further, over the first two quarters of financial year 2018-19 (April-September) transfers and remittances rose by 21 and 31 per cent respectively, pointing to a restoration of the long term positive trend. Moreover, more recently, despite the subdued level of oil prices and the budgetary problems countries like Saudi Arabia are facing because of lower oil prices and restrained production levels, remittance levels have remained high. In the long run, the volume of remittances has been high and the trend has remained positive despite the violent fluctuations in oil prices.

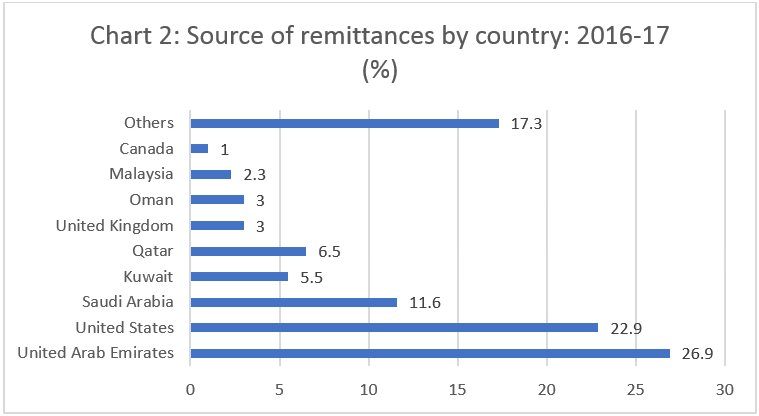

What is noteworthy is that over this period, remittances have substantially come from the Gulf region. This is contrary to expectations that with India becoming a successful exporter of software and business services, which often require onsite provision at locations abroad, there would be a shift in remittance flows away from the Gulf region to North America (especially the United States). It was expected that there would be higher contributions from workers employed on temporary visas (such as H1B) extending for more than a year at much high salaries than the earnings of the preponderantly semi-skilled workers migrating to the Gulf region.

The Reserve Bank of India has been conducting periodic surveys of remittance patterns since 2006. According to the most recent survey in 2016-17, as much as 53.5 per cent of remittances came from the Gulf countries, with the United States and Canada together contributing about 24 per cent (Chart 2). Earlier surveys, though not perhaps fully comparable, suggest that the share of the Gulf countries has been rising over time, from 24 per cent in 2006-07 to 27 per cent in 2009-10 and 37 per cent in 2012-13. Conversely, the share of North America in total remittances fell from 44 to 38 and 34 per cent in the same period. What this suggests is that the share of North America in remittances (and potentially, therefore, the remittances contribution of the IT and business services workforce abroad) peaked in the mid 2000s, and there has been a deceleration since then.

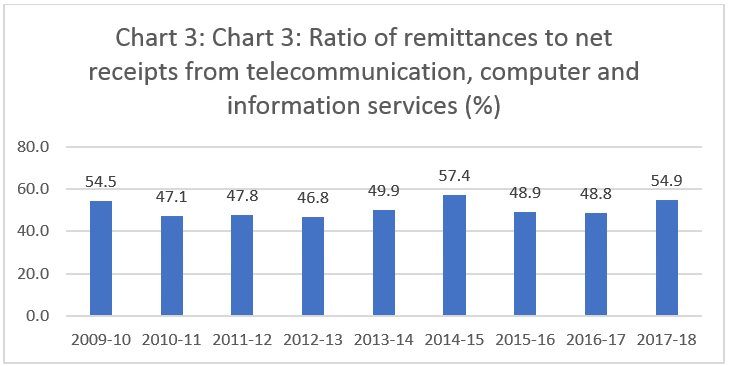

One question that arises is the importance of workers’ remittances relative to net export receipts from the IT and IT-enabled services boom. As can be seen from Chart 3, the ratio of net receipts from remittances to net receipts from the export of telecommunication, computer and information services fell from 54.5 per cent in 2009-10 to 46.8 per cent in 2012-13, then rose to 57.4 per cent in 2014-15, and after another decline stood at 54.9 per cent in 2017-18. That is, the contribution of workers’ remittances to foreign exchange inflow has been between 47 per cent and 57 per cent of inflows on account of India’s flagship export sectors. This has to be seen in light of the immense policy support that the IT and IT-enabled services sector has received from the government in the form of investment in infrastructure, tax holidays and beneficial import policies.

Whether or not the software and IT-enabled services export boom was substantially helped and driven by liberalisation, it is clear that the remittance boom cannot be attributed to any such policy regime. It is much more related to the policies of foreign governments on temporary employment of foreign workers. In such employment, families stay behind and workers need to remit foreign exchange for family maintenance and similar expenditures. According to the RBI surveys, the share of remittances meant to finance family maintenance varied between 49 and 61 per cent of total remittances. Another 20 per cent was into deposits, possibly to be withdrawn later to finance bulk expenditure requirements.

Thus, a fortuitous benefit of significant magnitude has accrued to India because of demands abroad and policies with regard to temporary migration adopted by foreign governments. Moreover, while the IT and related services boom was possibly helped by the technical and English language skills of a sections of Indian workers, no such special characteristic defines the semi-skilled workers migrating to the Gulf and elsewhere.

These fortuitous and large transfers and remittances have been a bonanza for India. Remittances accounted for between 23-32 per cent of the deficit in trade in Goods and Services between 2009-10 and 2012-13, and increased to cover between 47-80 per cent of that deficit between 2013-14 and 2017-18. That is no mean contribution. Workers’ remittances have shored up India’s balance of payments to a considerable extent.

Liberalisation was supposed to restructure the Indian economy and unleash its export prowess in manufacturing and services. Services have made their contribution, but the performance of manufactured exports has been dismal. That failure would have challenged the legitimacy of the neoliberal regime, as it has done in many other developing countries. Part of the reason it has not done so in India is because of the fortuitous benefit provided by migrant workers.

(This article was originally published in the Business Line on December 18, 2018.)