The 2020s is turning out to be a decade of great unravelling of the global…

Who’s manipulating China’s exchange rate? C. P. Chandrasekhar and Jayati Ghosh

A favourite trope of Northern economic policy makers – especially those in the United States – is that China systematically manipulates the exchange rate of the RenMinBi to ensure greater external competitiveness, and that this amounts to an unfair trade practice. While this has been a complaint of the US government for some years now, President Trump of the US has become a particularly strong advocate of this theory.

Most recently, the recent (slight) depreciation of the Chinese RenMinBi (RMB or Yuan) relative to the US dollar has been met with howls of protest from Mr Trump and his trade advisors, who have complained that this is a deliberate policy of the Chinese authorities to counter the effects of the tariff increases announced by the US administration as part of the ongoing trade war it has initiated.

It is certainly true that in the past three decades Chinese strategy has been largely oriented to keeping the currency “competitive” for the country’s exports, and there have been episodes when specific moves have destabilised trade patterns for other countries. For example, the RMB devaluation of 1994 is recognised to have led to declining export competitiveness of major Asian exporters, eventually becoming one of the significant factors leading up to the Asian crisis of 1998. But in the 2000s and thereafter, and especially after the Global Financial Crisis, the efforts of the Chinese authorities seem to have been directed much more towards allowing or encouraging the RMB to appreciate rather than sustain a lower value.

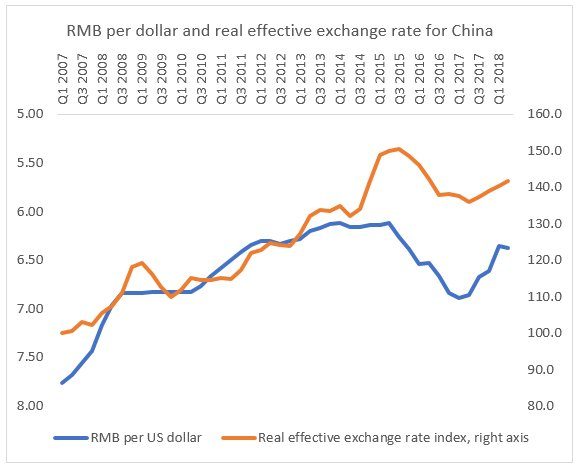

Figure 1 indicates the movement of the RMB relative to the US dollar, as well as the real effective exchange rate, since the first quarter of 2007, that is well before the GFC broke. It is evident that until the first quarter of 2015, there was a general tendency for appreciation in both variables. This hardly suggests a strategy of continuing undervaluation of the currency in order to enable cheaper exports, notwithstanding the more adverse global environment.

However, there was RMB depreciation until early 2017, more marked relative to the US dollar than in real exchange rate terms. There has been a recovery recently. The period of RMB depreciation is widely associated with “capital flight” from China.

Figure 1: Since 2007, the RMB appreciated – until quite recently

Source for all figures: IMF International Financial Statistics online

Source for all figures: IMF International Financial Statistics online

Figure 2: The big change from early 2014 was in the capital account

Figure 2, which describes the change in current and capital accounts of the balance of payments, shows that the real change from early 2014 onwards occurred in the capital account, which moved sharply from showing substantial surpluses (inflows of capital) to balance and even deficits (net outflows). This could certainly be indicative of capital flight, and was interpreted as such by many observers in the mainstream international financial media.

But it is hard to understand why there would be so much capital flight from an economy that still continued to generate substantial current account surpluses, and that held around $4 trillion in foreign exchange reserves around that time. Some have argued that there was significant flight of personal wealth in response to the anti-corruption crackdown by the Xi Jinping regime – but much of that would have been more likely to be recorded under “Errors and Omissions” than in the official capital account. So what was driving this net movement of capital flows?

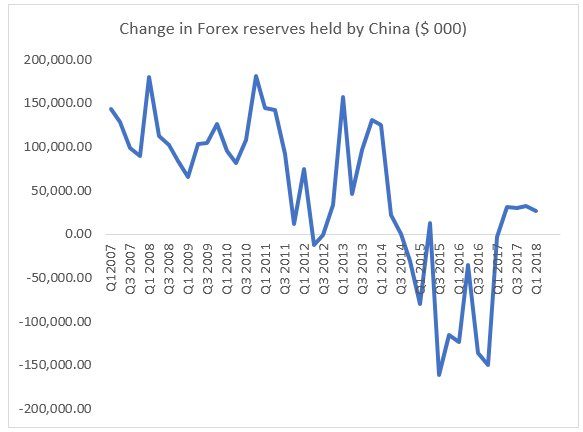

The perception of capital flight was heightened by the net drawing down of foreign exchange reserves, indicated in Figure 4. Analysts have pointed to this as clear indication that the Chinese monetary authorities were acting to shore up the currency through open market operations in the face of such capital flight.

Figure 3: Forex reserves fell by nearly $1.5 trillion between 2014 and 2017

But the actual explanation could be much more complex, and indicate more strategic thinking on the part of Chinese policy makers. Recent research by some Brazilian economists (“China: Capital flight or renminbi internationalization?” by Paulo Van Noije Bruno De Conti, paper presented to the 21st Conference of the Forum for Macroeconomics and Macroeconomic Policies, Berlin Germany, 9-11 November 2017) points to the possibility of a different and more nuanced official strategy.

Van Noije and Conti note that reserve holding generates very low returns, and especially when held in US dollar securities like Treasury Bills, generates excessive dependence on the US economy, which has long been a concern for the Chinese government. Therefore, there has been a push to diversify foreign asset holding, not only in the form of more variety in the composition of reserves, but through increased foreign investment in different forms. They further note that many of these investments, as well as more import payments, were settled in RMB rather than in US dollars. This would serve the further purpose of enabling the gradual internationalisation of the RMB by providing other countries access to this currency.

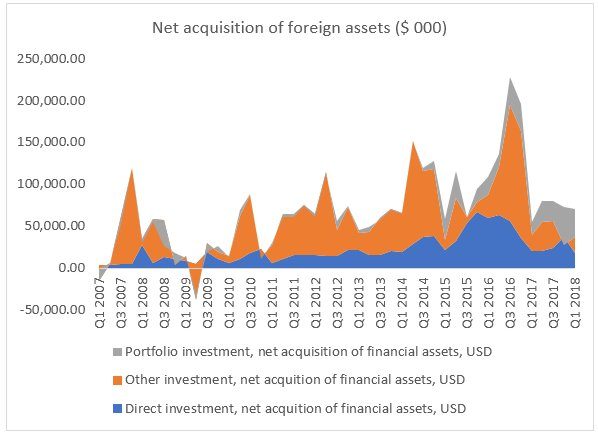

Figure 4 suggests that this has indeed been the case up to early 2018, with direct investment (mostly by Chinese State-Owned Enterprises) as well as other investment showing very large increases over this period.

Figure 4: Chinese outward investment has increased significantly

So there may have been some capital flight out of China, but this has clearly been combined with a more strategic shift in the pattern of foreign asset holding that must have involve state direction. Instead of wastefully holding reserves stored in low-return US securities, the Chinese may be diversifying at the margin to other asset holding in different countries. Currency market speculators would do well to consider the medium-term implications of this strategy before betting against the RMB.

(This article was originally published in the Business Line on September 10, 2018)