The weaponization of tariffs by US President Donald Trump has clearly generated fear and loathing…

A Legacy of Vulnerability C. P. Chandrasekhar and Jayati Ghosh

Recent months have been marked by an exit of foreign investors from India’s financial markets, triggered by the end of quantitative easing in the US and Europe and hikes in policy interest rates in the former. This has resulted over the last few weeks in a sharp depreciation of the rupee relative to the dollar, which not only raises the rupee costs of imports, but also the rupee equivalent of payments made to service foreign debt. That has meant that India is now paying the price for a legacy of debt built up during the years when the Federal Reserve and the European Central Bank sought to address the recession resulting from the 2008 financial crisis by infusing liquidity into the system, and flooding markets with large volumes of cheap money in the process. Credit at near zero interest rates was available to banks and financial agents to lend or invest at low rates to record profits and salvage their balance sheet hit by the crisis.

It is now well accepted that this strategy resulted in versions of the carry trade where banks, financial institutions and investors borrowed cheap in the dollar market and invested in assets denominated in other currencies offering significantly higher returns. There was always a risk that the currencies of countries hosting those investments could depreciate, eroding expected returns in dollar terms. But the returns were high enough to ignore or hedge against those risks, and the rush of funds into these countries not only shored up their currencies, but even resulted in appreciation, which further jacked up dollar returns.

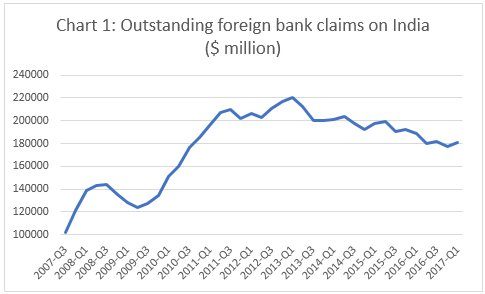

India was a country that benefited from flows of this kind. One proxy indicator of the extent to which this happened is the trend in foreign bank claims on institutions and firms in India since the crisis, available from the consolidated banking statistics database of the Bank of International Settlements. As Chart 1 shows, international bank claims on India rose by around 100 billion from the second quarter of 2009 to the second quarter of 2013, from $128 billion to $213 billion or by 66 per cent. While the figure has declined since, interestingly in the period since the Fed first announced its decision to ‘taper’ its “quantitative easing” policy, outstanding claims stood at $181 billion at the end of the second quarter of 2017.

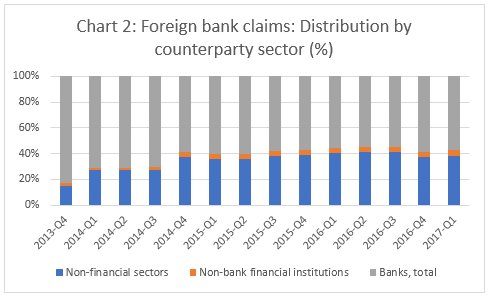

Disaggregated figures available for this period of relative decline show that the decline was more in the debt placed with banks and non-bank financial institutions (Chart 2). On the other hand, the share of non-bank non-financial institutions (that is, non-financial corporations) in claims outstanding rose from 15 per cent in the fourth quarter of 2013 to 42 per cent in the second quarter of 2016 and stood at 38 per cent in first quarter of 2017. The share of non-bank financial institutions also rose, but from a much lower base and to a much smaller extent. Clearly, India’s corporate sector had exploited the availability of cheap credit from foreign financial firms, resulting in a high proportion of outstanding foreign bank claims.

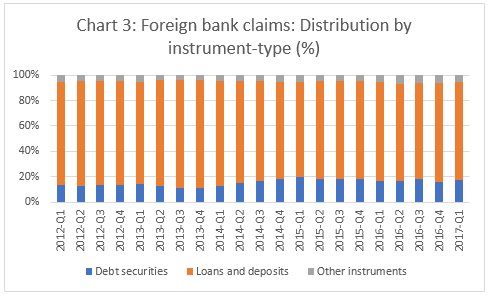

It is also noteworthy that there has been a change, though not striking, in the channels through which credit has been flowing into the country. The share of bank loans and deposits has come down from 86 per cent in the second half of 2013 to 77 per cent in early 2017, while that of debt securities has risen from 11 to 18 per cent (Chart 3). This is in keeping with the evidence that the corporate bond market in India, which had been inactive for long, had turned active in recent years. Those financial institutions engaged in the carry trade were willing to experiment with corporate bonds in search of returns. This suited Indian corporates, since bond issues are likely to be subject to less intensive scrutiny,as bond investors go by credit ratings when making investment decisions. However, exit is much easier for bond investors, who can choose to book profits or cut losses and leave, resulting in stress on the balance of payments and the rupee. In fact, a larger share of sales by foreign institutional investors in recent months has been in debt rather than equity markets.

Thus, legacy foreign debt creates two kinds of vulnerabilities. It can lead to rupee depreciation when investors engaged in carry trade choose to exit. This intensifies any depreciation resulting from other factors, such as a worsening the current account deficit due to oil price increases. Second, when depreciation increases the rupee costs of servicing foreign debt, it can lead to losses and push firms to default on both domestic and foreign debt. The latter is a strong possibility also because firm reputation influences access to foreign credit markets and institutions. For that reason, it is likely that this debt would be concentrated in a relatively small number of firms. So, the vulnerability that legacy debt creates arises not just from the volume of exposure but also from its likely concentration in a few firms that would have to carry the enhanced debt servicing burden that rupee depreciation results in.

It is true that the ultimate source of these problems is the supply-side push of cheap credit from developed country markets. But this would not have led to the vulnerable situation India finds itself, if its own corporates, whose thirst for credit is amply illustrated by the country’s bad debt problem, had not been encouraged by policy to exploit that supply-side push. Not only have the ceilings on external commercial borrowing been relaxed hugely over the liberalization years, but foreign investors have been given easy and substantially enhanced access to the country’s debt markets, including the corporate debt market. That shift in policy ensured that when the opportunity arose, debt exposure would increase rapidly, creating the vulnerabilities that are now starkly evident.

(This article was originally posted in the Business Line on July 2, 2018.)