Donald Trump’s tariffs have disrupted supply chains, roiled global markets, and escalated the trade war…

Once again, the Oil Price Scare C. P. Chandrasekhar and Jayati Ghosh

The news last week that prices of Brent Crude oil (which is used as a global benchmark) had crossed $80 a barrel in some markets must have created shock waves in policy circles of many countries, especially India. Many oil-importing countries had grown comfortable with – and even complacent about – the relatively low oil prices that persisted after their precipitous drop in the middle of 2014.

As Chart 1 shows, average oil prices feel very sharply after June 2014, falling by 56 per cent just in the months until January 2015, and by more than 70 per cent from their earlier peak in 2012. Thereafter, they mostly remained at relatively low levels until January this year. This reflected the general deflationary atmosphere prevailing in the global economy, as well as subdued demand in the face of significantly increased supply because of the shale boom in the US as well as more production in countries like Iran as sanctions were lifted.

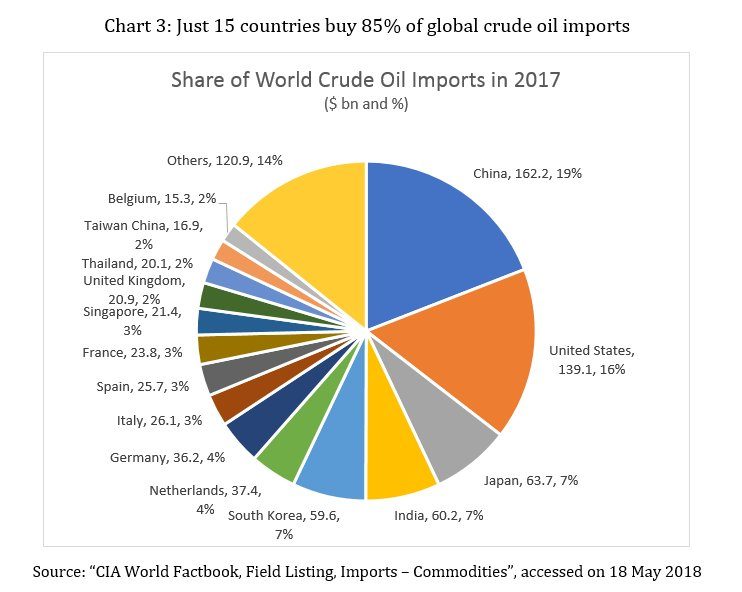

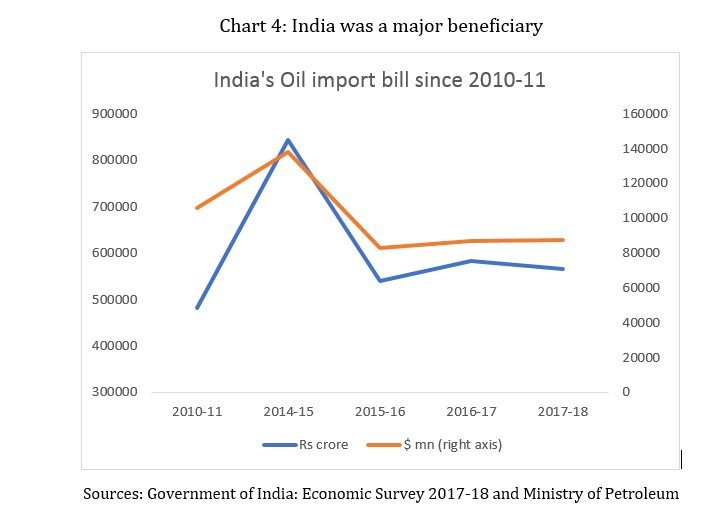

Several oil-importing countries were major beneficiaries of this decline. The top 15 importing countries (described in Chart 3) all managed to increase the volumes of their crude oil imports between 2013 and 2017, without any increases in the value of imports. In fact, several of them benefited from significant declines of oil import value. Chief among these beneficiaries was India, with nearly 60 per cent fall in the value of crude oil imports between 2013 and 2017, but obviously others like China, Japan, Germany and the UK also gained in this way. In the US, while the oil import bill came down dramatically, the fallout of low oil prices was more complicated because it affected the viability of the nascent shale oil industry.

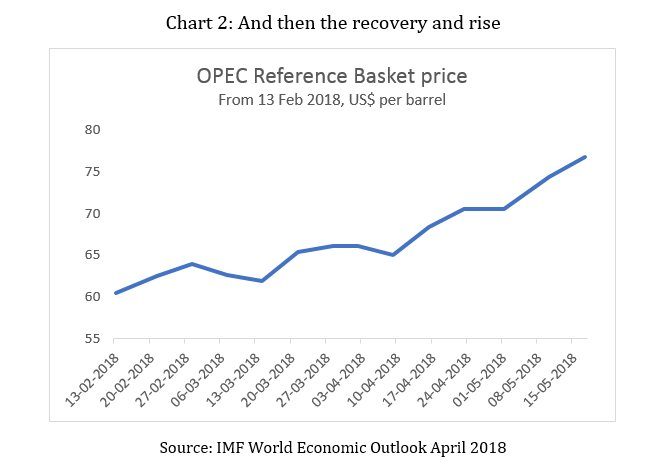

But that was then – and now the situation already looks very different. Since early 2018, oil prices have been rising once again, as indicated in Chart 2. In the three months up to 15 May, the price of the OPEC reference basket went up by 27 per cent – and since then reports are that they have continued to increase at an even faster pace.

Once again, several factors are behind this latest price surge, and since some of them are determined by political instability, the future impact on prices is hard to predict. One big factor has been the willingness of Saudi Arabia (which had earlier refused to cut production hoping that low prices would force out the US shale producers) to change its tactics and join other members of the OPEC cartel in limiting production to stabilise and increase oil prices. In addition, since December, Russia and 10 other non-OPEC countries joined forces with OPEC to result in an additional supply cut of more than 500,000 barrels a day. But other factors driving the price increase are more volatile: the uncertainties created by the Trump administration walking out of the Iran nuclear deal and re-imposing sanctions; the ongoing instability in the other countries of the Middle East; the political turmoil in Venezuela, the largest producer in Latin America.

Once prices start increasing, speculative activity also enters the picture, and with greater uncertainty, the greater the chances that speculation will drive prices even higher. This is what seems to be happening in oil markets now, in a febrile market volatile around a rising trend.

For the oil-importing countries that were reaping the benefits of low oil prices, this has already had quite an impact. Among developing countries, China (with nearly a fifth of global crude oil imports) and India (with 7 per cent) are particularly affected. While other large importers are all advanced countries, even developing countries that are small net importers are negatively affected because oil as the universal intermediate affects the prices of all other goods as well as many services.

The consequences for such importing countries will be manifold. Obviously, the first direct impact will be on the balance of payments, as import bills that were kept low by the low oil prices will now increase, affecting trade and current account balances. There will also be inflationary consequences, as the oil price increase has a cascading effect on other prices. To the extent that this affects investor confidence, there could also be adverse impacts on capital flows and other domestic investment.

Of course, the inflationary impact also depends on the extent to which the oil import price is passed on to consumers, as such prices are either administered or face heavy taxation in most countries. In India, for example, taxes account for more than half of the domestic price. Since the taxes are ad valorem, higher import prices could provide further windfall gains by increasing tax revenues even as they squeeze consumers and reduce real incomes of the poor. But if the effect is sought to be cushioned at least to some extent (a likelihood in an election year) then there could also be an adverse fiscal effect.

Chart 4 provides some idea of what this could mean simply for India’s oil import bill. Over the past three years, low global crude oil prices have kept India’s oil imports stagnant at a level lower by around one-third of the oil import bill in 2014-15, despite increases in the volume of imports. Those happy days are clearly over. The current price, if sustained for the next months, would already lead to a 25 per cent increase in oil import value in the current fiscal year – and any further increase would have greater implications.

India relies on imports for 80 per cent of its oil consumption, and will find it hard to reduce this in the short term. In 2017-18, the trade deficit had already nearly doubled to $87 billion from $48 billion in the previous year. There are clearly looming risks for India’s economy.

(This article was originally published in the Business Line on May 21, 2018.)