Donald Trump’s tariffs have disrupted supply chains, roiled global markets, and escalated the trade war…

The Collapse in Developing Country Exports C. P. Chandrasekhar and Jayati Ghosh

If there has been one big change in the nature of the global economy in the second decade of this century, it is in global trade. In the first decade of this century, especially in the period 2002-08, cross-border trade grew much more rapidly than total world output, and the integration of countries through greater exchange of goods and services essentially became the primary engine of growth. It is true that the explosion of financial activity that has become such a prominent feature of contemporary capitalism also added substantially to income growth – and indeed generated the bubbles that were then expressed in more trade. But whatever the origins, this period was also the apogee of trade globalisation.

In the process, a few developing countries – particularly China – emerged as major beneficiaries of such trade expansion, and then brought about a significant increase in what was known as South-South trade. The geographical relocation of production and the emergence of global value chains generated significant increases in intra-industry trade among developing countries, which were often directed to final demand in advanced economies, but simultaneously enabled income and demand expansion in the periphery. The associated growth of several emerging economies was more rapid than in the core, giving rise to theories of global income convergence and even of the “decoupling” of some countries in the periphery (particularly those in developing Asia) from the growth poles in the North.

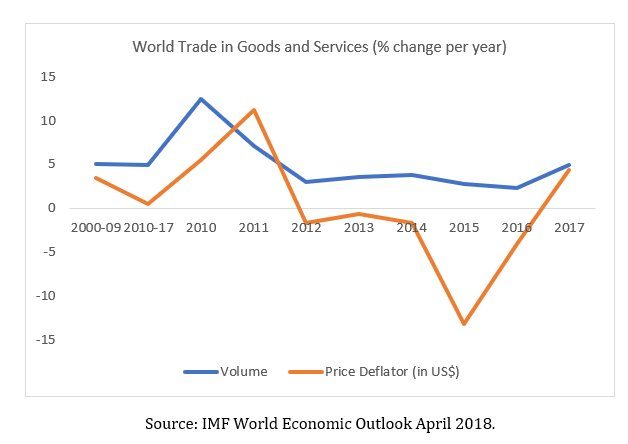

The Global Financial Crisis put paid to the latter theory, even as the arguments about greater income convergence were shown to be overly based on a very limited number of “success stories” in the developing world. But the pattern of trade in the decade after the crisis has shown the fragility of that trade expansion. As indicated in Figure 1, the period after 2010 in particular has been marked by a significant deceleration of world trade in goods and services. Most of this has been because of price collapses, as volume changes have been much less marked. While trade volumes grew by an average of 5 per cent per annum over 2000-09, they decelerated only marginally to 4.9 per cent in the period 2010-17. However, changed in world trade prices slowed down from 3.4 to 0.5 per cent per annum in the subsequent period, causing the growth in world trade values to fall below global output growth for the first time in the period of globalisation (that is, after 1980). Indeed, in the years 2012-2016 world trade prices fell, sometimes sharply, driven by the end of the commodity cycle that meant falling oil and primary commodity prices. The slight recovery in 2017 still left global trade values around 15 per cent below those prevailing in 2011.

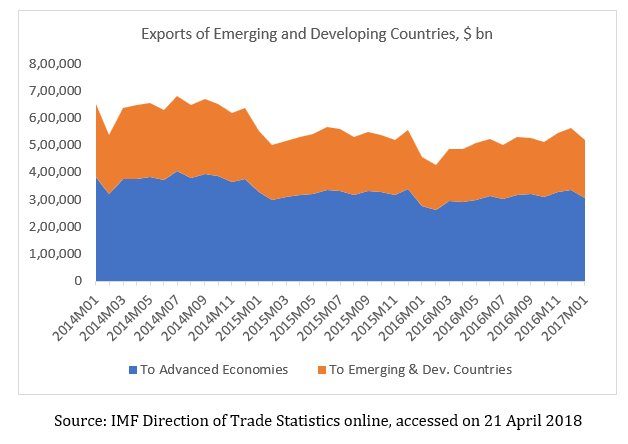

Since so much of the growth experienced by developing countries during the boom was export-led, this slowdown and even decline in trade has obvious implications for their growth strategies. If anything, the situation has deteriorated in the most recent period. Figure 2 shows that there have been absolute declines in export values (in US$ terms) of developing countries since January 2014. This has been so evident that the value of exports of developing countries in the six-month period July-December 2016 was as much as $725 billion less than the value three years earlier, in July-December 2014. Much of this decline was due to South-South trade: while exports to the advanced economies declined by 20 per cent over this three-year period, those to developing countries fell by 25 per cent.

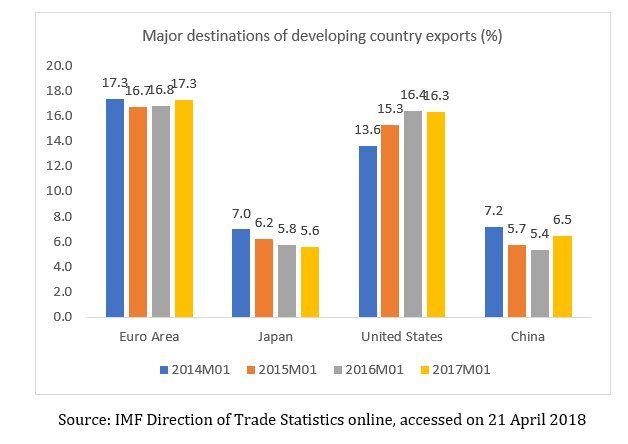

One of the most striking features has been the dampened significance of China as an important market for developing country exports. One of the most widely remarked features of recent world trade has been the dramatic emergence of China as a substantial player in global trade, not only because its exports have penetrated nearly all countries’ markets, but because it had become a major destination for developing country exports, for both raw material and intermediate exports in particular. China’s demand even drove up the prices of many primary products, leading to terms of trade improvements that contributed hugely to increased incomes in primary exporting countries. But in the past three years, China’s share of the total exports from developing countries has a group has fallen, and recovered only slightly very recently. Conversely, the shares of the Euro Area and the United States have largely maintained or increased slightly. (It should be noted that developing country exports here include exports from China, which complicates the matter slightly – but this should not affect temporal changes too much.)

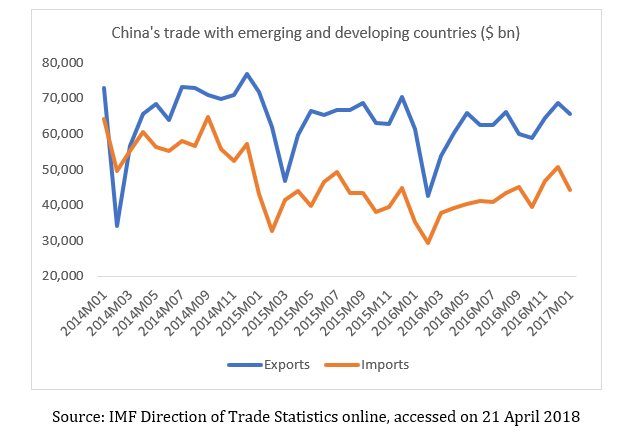

The lower demand from China meant that, between July-June 2014 and July-June 2016, developing country exports to China fell by $78 billion, amounting to around a quarter of the overall decline in exports to other developing countries. Figure 4 shows how this reflects the change in China’s own external strategy. As the Chinese economy rebalances towards more domestic demand-led growth rather than export-led growth, it requires less imports from developing countries to use in processing for further export. This explains partly why – even as Chinese exports to developing countries have been volatile but still remained largely at the same level since January 2014, imports from developing countries fell quite sharply in early 2015 and since then have stagnated at the lower levels.

What this suggests is that China is unlikely to play the same role of providing a much-needed demand impetus for developing country exports, that it played in the earlier decade. The possibility of Asia becoming a viable alternative growth pole for the world economy is also thereby undermined. The sooner other developing countries wake up to this reality and adjust for it in their own trade strategies, the better for them.

(This article was originally posted in the Business Line on April 24, 2018.)