Liberal opinion holds that the international monetary and financial system is a device for promoting…

Do Purchasing Power Parity Exchange Rates Mislead on Incomes? The case of China C.P. Chandrasekhar and Jayati Ghosh

Ever since Robert Summers and Alan Heston produced what become known as the “Penn World Tables” comparing prices and thereby the purchasing power of currencies across countries, the urge to use some deflator of market exchange rates to compare incomes across countries has been strong. The economic theory behind this is that exchange rate comparisons of less-developed economies consistently undervalue the non-traded goods sector, especially labour-intensive and relatively cheap services, and therefore underestimate real incomes in these developing economies. In some cases, this can be quite significant. In larger emerging markets like China and India, the conversion factors have been so large (up to four times) that China became the second largest economy in the world and India the sixth largest, on the underlying basis that their currencies command several times more goods and services than are reflected in the market exchange rates.

The International Comparison Project (ICP) now managed by the World Bank is the culmination of this attempt to draw more realistic comparisons of income: an estimation of GDP across countries and over time, based on periodic surveys and with some rough attempts at normalising for the basket of goods and services whose prices are compared. This results in PPP exchange rates, which have become the standard way of comparing incomes across countries and over time, and provide the underpinning for all estimates of international inequality.

But there are several problems with the estimates of income using exchange rates based on PPP. One is that of deriving the actual price comparisons. Obviously, PPP calculations should be based on comparing the prices of identical (or at best very similar goods) in different countries, and these should in turn be the goods that are most commonly represented in total expenditure. But this is easier said than done. It is almost impossible to find identical goods across different countries, which dominate consumption and investment. At first, the standard was the “average” basket of consumption in the United States. But there is no reason for this basket to be the same or even similar in other countries and in fact every reason why they should be different in countries at very different levels of income.

It is quite obvious, for example, that the share of food in the average consumption basket will be much higher (at nearly half) in a country like India, compared to the US (where it is around 10 per cent). If food prices rise faster than other prices (as they certainly did over the past decade) then a low weight to this will give a very misleading picture of the real income of the average person in India, and an even worse idea of the real income of a poor person.

Criticisms like this meant that the ICP evolved considerably, and became much more sophisticated and nuanced in generating the comparison basket. Regional PPPs are now imputed using national accounts expenditure as weights (and integrated through a Fisher index), and then linked to form a global set of PPPs through inter-regional linking factors that are calculated based on prices of global items collected in all ICP regions.

Another problem is that of discovering the actual prices of goods and services, and determining the representative prices in each country. This obviously has to use either existing price data or data from surveys that are constantly updated – but since prices also vary substantially within countries, the choice of surveys and aggregation are important. All this can be quite difficult, as the case of China illustrates. Before 2005, no survey was undertaken at all in China, and the findings of the 2005 survey indicated higher than projected prices, which then led a 40 per cent decline in the PPP-adjusted per capita GDP, compared to the 2000 estimate. The subsequent 2011 price survey led to a significant upward revision.

There is a less talked about but probably even more significant conceptual problem with using PPP estimates. In general, countries that have high PPP, that is where the actual purchasing power of the currency is deemed to be much higher than the nominal value, are typically low-income countries with low average wages. It is precisely because there is a significant section of the workforce that receives very low remuneration, that goods and services are available more cheaply than in countries where the majority of workers receive higher wages. When even these activities are further subsidised by the widespread incidence of unpaid labour (as is typically the case in poor households in low income countries) then it is clear that the greater purchasing power of that currency reflects conditions of indigence and low or no remuneration for probably the majority of workers. Therefore, using PPP-modified GDP data may miss the point, by seeing as an “advantage” the very feature that reflects greater poverty of the majority of workers in an economy.

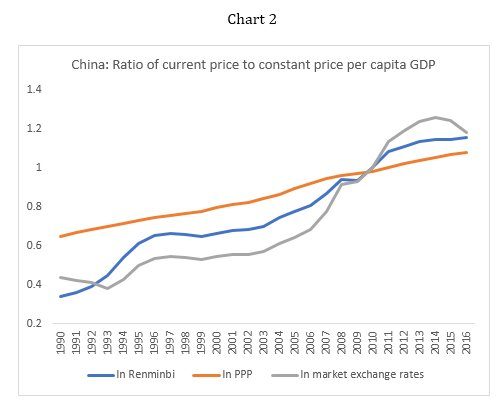

As aggregate incomes increase, wages and prices in that economy also increase, typically relatively faster than in richer countries, thereby reducing the s-o-called “PPP advantage”. This is amply shown in the case of China – Chart 1 shows how the ratio of per capita income measured in PPP terms to that measured in market exchange rates declined from a high of nearly 4 to less than 2, particularly after the mid-2000s as the economy actually became richer. As Chart 2 indicates, this was essentially because prices in China (as expressed in the GDP deflators in Renminbi and in current US $) moved upwards faster than in comparison countries especially in the later period, something that the assumption of the smooth PPP line fails to capture.

In other words, a country’s exchange rate tends to be “low” – or the disparity between the nominal value of the currency and its “purchasing power” tends to be greater – because the wages of most workers are low or even non-existent. A low currency economy is a low wage economy, and as its wages and therefore prices increase over time, the PPP gap tends to be progressively reduced. This makes inter-country comparisons of per capita income based on PPP potentially misleading in that they do not properly reflect the actual material conditions of most of the people living in them. This can also affect the consideration of changes in real income over time.

( This article was originally published in the Business Line on December 4, 2017)