Liberal opinion holds that the international monetary and financial system is a device for promoting…

The Worrisome Return of Capital C. P. Chandraekha and Jayati Ghosh

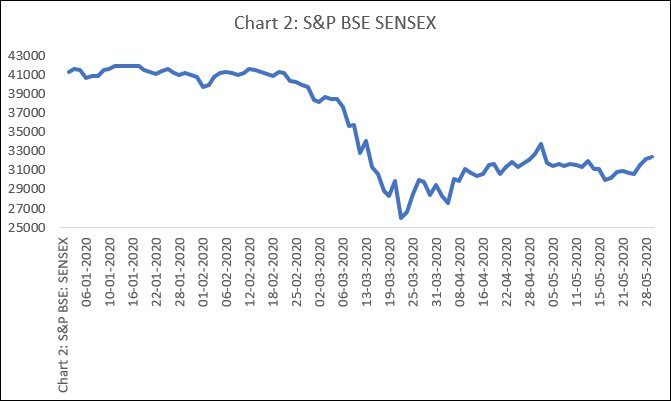

In a trend which sees equity markets in the “emerging economies” imitate stock markets in the US, the MSCI Emerging Market Index that collapsed over the month ending 23 March, from more than 1,100 to just above 750 (Chart 1), has since been on the rise, touching 930 by the end of May. An emerging market (EM) like India, which has been a favoured destination for foreign portfolio investors, has shown exactly similar trends (Chart 2). Over the month ending 23 March, the S&P sensitive index (SENSEX) capturing trends in the Bombay Stock Exchange had fallen sharply from more than 41,500 to just below 26,000, only to rise to a peak of close to 34,000 at the end of April. Though the revival was cut short, the index at the end of May stood at close to 32,500, which was well above its recent low.

As in the US, this behaviour of stock indices in emerging markets is paradoxical, inasmuch as the Covid-induced crisis has only intensified as the lagged effects of the lockdown are only beginning to be felt. GDP growth in most of these economies is expected to fall sharply to negative levels in the second quarter of 2020 and unemployment levels are likely to remain high and even rise.

The one factor common to explanations of stock market performance in emerging economies is the behaviour of foreign portfolio investors, which is influenced by the policies adopted by central banks in the US and other developed countries. These central banks have dramatically increased the flow of liquidity to banks and a range of non-bank institutions, and cut interest rate to near-zero, zero or negative levels. The opportunity this creates for profit making is obvious: it enables access to capital at extremely low rates and encourages investment in various assets that are lucrative even when they offer relatively low nominal rates of return. Emerging market equity is one such asset, and to the extent that foreign investors target those assets, EM equity markets are bound to perform well, irrespective of trends in the real economy.

The evidence suggests that capital flows to emerging markets have indeed been volatile, supporting that view that these flows drive volatility in equity markets as well. That evidence comes from the Institute of International Finance (IIF), which is the quickest source of information on capital flows to emerging markets, even if the countries it includes in the EM category and the methods it adopts are different from that of institutions like the IMF. The IIF reported in April that: “The COVID-19 shock has resulted in a pronounced sudden stop in capital flows to emerging markets”, and that “2020Q1 witnessed the largest EM outflow ever, exceeding the worst points of the GFC”. Net capital flows to emerging markets as a group experienced a stop in February 2020, amounting to just $0.2 billion, and then turned hugely negative in March, to the tune of $83.3 billion.

The main driver of the collapse in capital flows in March was a large outflow of portfolio capital estimated at $83.3 billion. Portfolio capital inflows includes both debt and equity investment, both of which contributed to the March collapse. Debt inflows that were positive in February turned negative with the figure touching minus $31 billion in March. Emerging Asia was a major contributor to this turn, with debt inflows moving from a positive $4.5 billion in February to a negative $19.5 billion. Since this suggests that short term debt is not being turned over, resulting in larger outflows than inflows, it is a matter for concern. Equity outflows too were rising from -$5.5 billion to a huge -$35.9 billion. Across the group as a whole, equity outflows are estimated at a total of $52.4 billion in March. In the event, in the three months ending March, emerging markets recorded cumulative portfolio equity outflows of $72bn and debt outflows of $25bn, or a total of close to $100 billion.

Based on this initial evidence, the IIF had forecast that capital flows to emerging markets would recover only in the second half of 2020, and probably following the resumption and revival of economic activity. But when the first estimates came in for April, the scenario had changed considerably. IIF estimates net capital inflows to emerging markets in April at a positive $17.1 billion. Two factors appear to have triggered this quick move to positive territory. One was significant positive debt flows into EMs in April, estimated at $15.1 billion. Clearly, the differentials in interest rates in capital flow source and destination countries were encouraging carry trades, with debt flowing despite poor economic conditions. The second was that China, where the Covid-pandemic was moderating and the government was gearing itself to spurring a recovery, seems to have escaped the equity outflow syndrome that had afflicted the EMs. Net flows of portfolio equity investments in April stood at a negative $6.3 billion in EMs excluding China, whereas flows to China were a positive $8.2 billion, resulting in a net inflow of $1.9 billion into EMs as a group.

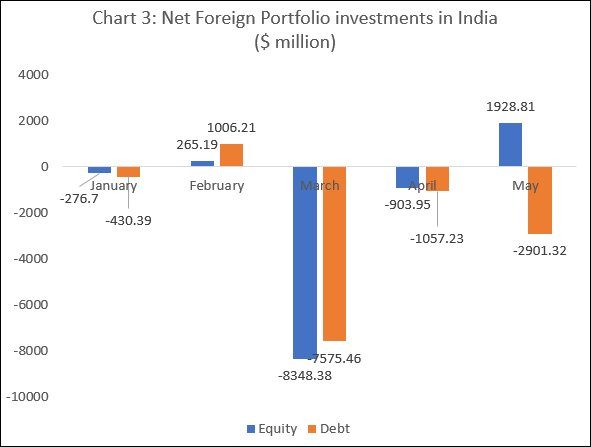

But if the outflow of equity capital persisted through April in EMs outside of China, the behaviour of stock markets in some at least of these EMs cannot be explained by foreign investment activity in equity markets. One explanation for this absence of a clear relationship between stock market revival and capital flow data across the EM group could be the differences in capital movements to equity markets in different countries within the group. As noted earlier, China has performed dramatically differently when compared to equity markets in other EMs. Evidence from India is also telling. That evidence suggests that foreign investor flight from India’s equity markets observed in March, significantly moderated in April and reversed in May (Chart 3).

While volatility has also characterised portfolio investment flows to India’s debt markets, those flows have remained negative and significant in all five months of this year. Even as they remain cautious about investing in debt instruments issued by beleaguered corporations, foreign portfolio investors seem to be willing to use cheap capital to participate in equity markets in the midst of a crisis.

In this context of selective targeting of particular EMs, celebrating a revival in an EM equity driven by carry trade investments by foreign portfolio investors is clearly short sighted. The country chosen as the favoured destination may change. Or new fears generated by the pandemic and the crisis it has induced may trigger another episode of capital flight. Given the combination of the real economy crisis that has engulfed the world and the widely-favoured policy response of injecting cheap money into the system, the better option may be to devise policies that prevent a speculative surge in financial markets riding on that liquidity.

(This article was originally published in the Business Line on June 2, 2020)