For

several centuries - between the 15th and the early

19th centuries - mercantilist theories dominated the

attitude to trade in Europe. This was the belief that

an economy that had positive net exports (through

exports being greater than imports) would be wealthier

because it would lead to an inflow of bullion, or

assets, and thereby increase its economic strength.

This approach led to economic policies designed to

increase exports and suppress imports, trade wars,

and even the colonial wars that were crucial to ensuring

markets for the various European powers.

There were of course many flaws of mercantilist theories,

most notably the confusion of bullion with real economic

wealth, the lack of recognition of the various benefits

of greater trade independent of the trade balance,

and the failure to perceive that the purpose of increasing

exports is to be able to import more, and thus raise

the level and variety of consumption in the society.

For a relatively long time, mercantilist arguments

have been discredited. But recently, a new form of

neo-mercantilism has emerged and has propelled the

economic models of the two economies that are increasingly

seen as the most successful and potentially powerful

in the world: China and Germany.

Mercantilism - the obsession with net exports - is

often seen as identical with export-led growth, but

in fact the two are not the same. It is possible to

have exports as the basic engine or driver of growth

without necessarily running a trade surplus. All that

is required is that export demand becomes a catalyst

for growth in the rest of the system and generates

additional demand.

Indeed, some of the classic examples of recent export-led

growth, such as the East Asian “dragons” or the Southeast

Asian economies, generally ran trade deficits during

their period of high export-led growth. Even China's

trade surpluses are of relatively recent vintage,

since the country had trade deficits during the period

of rapid export growth from the early 1980s to the

late 1990s, and only started having large trade surplus

in the early part of the 2000s.

However, for the last decade in particular, both China

and Germany have been increasingly reliant on a strategy

of growth that requires pushing out more and more

net exports. This in turn has required suppressing

domestic wages and consumption. In China the consumption

to GDP ratio fell from 46 per cent of GDP in 2000

to less than 36 per cent in 2007, while in Germany

it fell from 60 per cent to 56.5 per cent in the same

period.

Why would such a strategy be attractive at all? After

all, no one really still believes that an inflow of

bullion (or a net accumulation of financial assets,

which amounts to the same thing) is of great intrinsic

value for an economy. It could be argued that the

current strategy is based on a different notion of

the gain; one which recognizes the absence of full

employment and seeks to use trade as a means of maximizing

employment. Thus net exports are valued because they

involve more productive jobs at home and less leakage

of jobs through imports. To that extent, this is also

a form of beggar-thy-neighbour economic strategy,

since it involves creating or preserving jobs in your

own country at the expense of jobs in your trade partners.

This argument too is essentially fallacious, because

it does not recognise that while trade can affect

the pattern of employment, the aggregate level of

employment is determined by macroeconomic policies.

The possibility of employment in non-tradable activities

making up for employment losses through trade (which

would have to be the result of active government intervention

as well) is not considered.

Despite this, the urge to generate trade surpluses

has become an important plank of the overall economic

strategy in both countries. It is possibly even more

marked in Germany than in China, which has seen some

recent moves to develop the home market.

Even more than export-led growth per se, such a strategy

involves a fallacy of composition, in that all countries

cannot pursue it. Indeed, the dependence of the surplus

economies on the existence of other countries that

are simultaneously running deficits is only too obvious.

In the recent past, that has come from a combination

of one large global player (the US economy, which

has served as the engine of growth for much of the

rest of the world) and a number of smaller economies

running smaller deficits financed by capital flows.

This gives rise to a classic dilemma of mercantilist

strategy, which is evident in an exaggerated form

today for the neo-mercantilist economies: they are

forced to finance the deficits of those countries

that would buy their products, through capital flows

that sustain the demand for their own exports. Thus

it is no accident that China and Germany are both

large investors in the US and purchasers of US Treasury

Bills, or that German banks are heavily implicated

in lending to the now-fragile deficit economies in

the European Union.

Despite these contradictions and dilemmas, such a

strategy can certainly be successful for a while,

and this can be true even over the economic cycle.

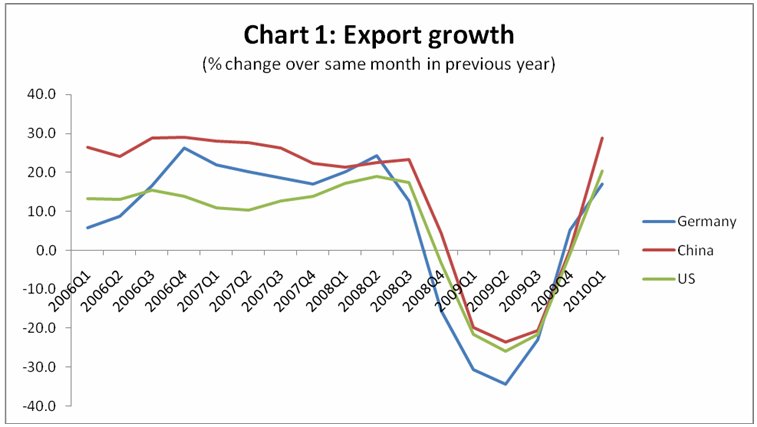

This is evident from Chart 1, which shows how both

China and Germany experienced very sharp declines

in export growth in the wake of the recent global

crisis, but have since rebounded sharply.

(It should be noted that all charts refer to merchandise

trade only.)

Interestingly, Chart 1 also shows

how the United States economy had been showing reasonably

high export growth before the crisis and how its export

growth has also revived (largely related to dollar

devaluation) in the most recent period.

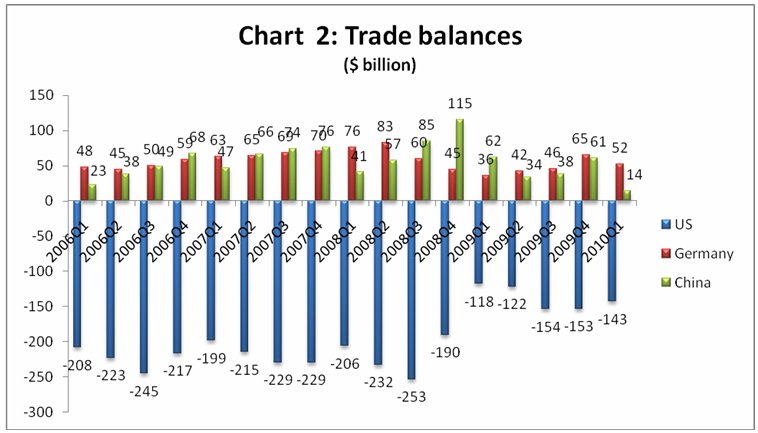

Chart 2 indicates how the trade surpluses of these

two mercantilist economies are related to the deficits

run by the US. The US deficit is obviously much larger

than the combined surpluses of these two countries,

but as it has shrunk slightly in the wake of the crisis,

so have their surpluses.

Nevertheless, both countries have

maintained the tendency to generating trade surpluses,

alough there has been some shift within China. In

Germany, the ability to impose wage restraint throughout

the period of economic boom and rising labour productivity

were remarkable in their scope, and critical to the

enhanced competitiveness of the economy. During the

crisis, employment levels fell relatively little,

not only because of the existence of automatic stabilisers

that provided a countercyclical cushion for the economy,

but also the willingness of German workers in export

industries to accept effective wage cuts rather than

lose employment.

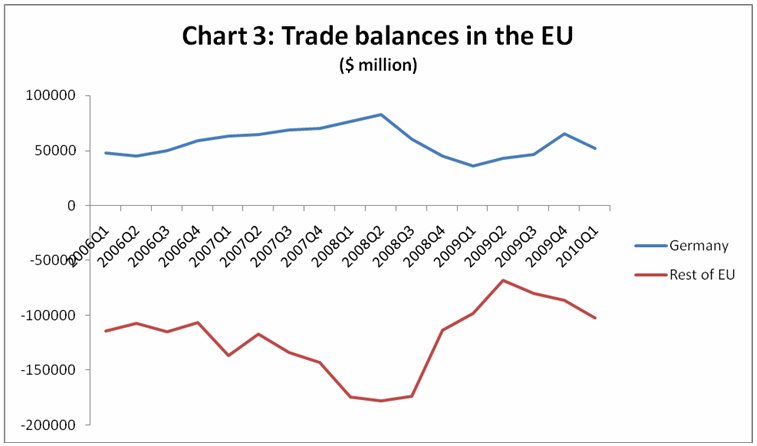

In any case in Germany, a significant part of the

export surplus is generated from trade with other

partners in the Euopean Union (EU). Intra-EU trade

accounts for around two-thirds of total EU trade,

and an equivalent part of German trade as well. Chart

3 shows how movements in Germany's trade surpluse

have been closely mirrored by movements in the aggregate

deficit of all other EU countries.

It is this misalignment within Europe

that is at the heart of the economic problems faced

by many deficit countries in the region today. There

is a basic difference between price levels in Gemany

and most other EU members, resulting from the fact

that Germany has been able to keep wages nearly stagnant

even with rapid labour productivity increases, while

other countries are not able to let the gap between

wages and productivity widen to that extent. This

means that prices of many goods and servies are significantly

lower (sometimes by as much as one-third) in Germany

compared to most other European economies.

Remarkably, therefore, there are real exchange rate

mismatches within a common currency area. Obviously

this reflects another significant failure, that of

the European Single Market to ensure price arbitrage

of traded goods, or wage equalisation through the

movement of labour.

What is more significant for present purposes is that

such mismatches cannot continue indefinitely. Already

the deficit countries in Europe - not only those whose

goverments' bond markets are in difficulties but others

as well - are being forced to cut down on imports

through very severe austerity measures that are reducing

both output and employment. Ironically, such moves

are being strongly pushed by the German government

inside the EU, even though this is likely to rebound

adversely on the German capacity to generate export

surpluses.

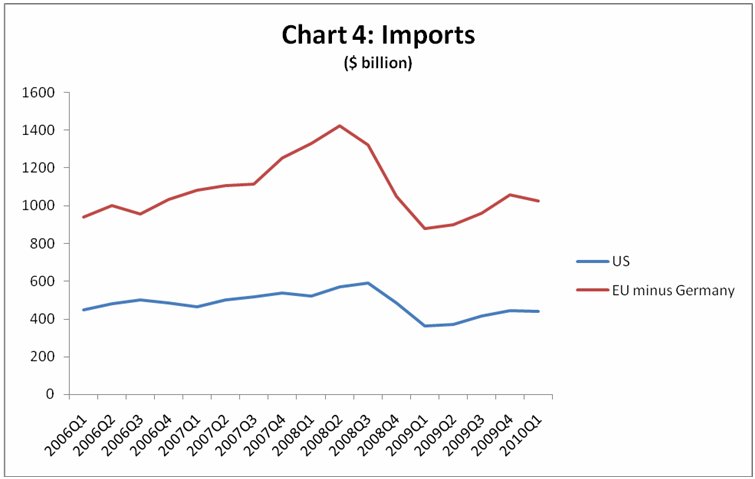

In the US, the external adjustment will also clearly

occur, whether through exchange rate movements or

increased protectionism, or in any other manner. Chart

4 suggests that this process is already underway:

although import levels of both the US and non-Germany

EU have recovered slightly from the trough of early

2009, they are still far below the earlier peaks and

also appear to be levelling off despite the recent

output recovery.

So, while the neo-mercantilist strategy

can be apparently successful for a while, it is likely

to come up against both internal and external constraints.

Internally, the potential for suppression of wage

incomes and domestic consumption will meet with political

resistance. Externally, deficit countries will either

choose or be forced to reduce their deficits through

various means. In either case, the pressures to find

more sustainable sources of economic growth, particularly

through domestic demand and wage-led alternatives,

are likely to increase.

September 7, 2010.

|