Despite

periodic statements to the contrary, the annual budget

of the Government of India is a major instrument of

its economic policy. It reveals the fiscal stance

– expansionary, neutral or deflationary – of the government

at each point in time; it reflects its economic policy

priorities; and it discloses the way in which the

burden of financing the pursuit of those priorities

is sought to be distributed. To these features characteristic

of all budgets must be added the special nature of

Budget 2004-05. Coming as it did in the wake of what

to many was a surprise election verdict against the

NDA and its economic policies, this budget was expected

to mark a departure from the neo-liberal economic

regime of the 1990s that had resulted in agrarian

distress, near-stagnant employment growth, inadequate

progress in poverty alleviation and a sharp increase

in urban inequality.

The first impression is that Finance Minister P. Chidambaram

has responded to the election mandate for a redirection

of economic policy. Part A of his budget speech is

peppered with copious references to agriculture, education,

health and employment, even if the financial allocation

for many programmes under these heads amounts to mere

tokenism. In addition, he has made a special allocation

of Rs. 10,000 crore for the Planning Commission to

implement the National Common Minimum Programme (NCMP)

of the UPA.

To finance these commitments, he appears to have made

some efforts at resource mobilization as well. He

has stuck by the promise made in the NCMP to impose

a 2 per cent cess to mobilise about Rs. 4,000 crore

for education. He has imposed a tax, even if only

a marginal 0.15 per cent, on stock market transactions.

He has increased the service tax from 8 to 10 per

cent and extended its reach by adding a number of

sectors to the 58 already being taxed.

While all these can be seen as positive steps forward

in redeeming election promises and fulfilling the

election mandate, a close look at the budget results

in disappointment. To start with, the new government

has chosen not to depart from the macroeconomic framework

typical of the pre-existing neo-liberal regime. As

the Economic Survey had noted, India's food stocks

are still at relatively comfortable levels; it has

access to an embarrassingly high reserve of foreign

exchange; and industry is characterized by substantial

excess capacity. This offers an opportunity to launch

an expansionary fiscal programme, which, if focused

on investments in irrigation and the infrastructural

areas, can result in output and employment growth

and help raise savings and government revenues that

can partly finance the expenditure undertaken to realize

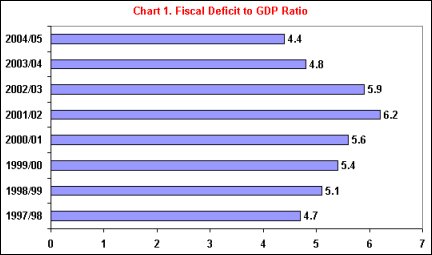

that expansion. However, accepting the irrational

constraints on fiscal policy set by the Fiscal Responsibility

and Budget Management Act, the Finance Minister has

chosen to limit the fiscal deficit at 4.4 per cent

of GDP.

|

|

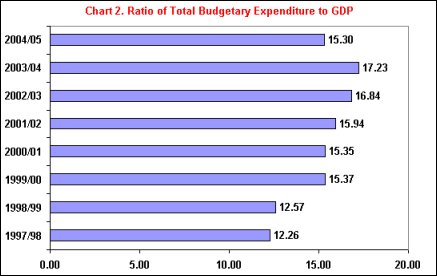

The result of this fiscal conservatism parading as

fiscal prudence is that the aggregate expenditure

budgeted for 2004-05 is, at Rs.4,77,829 crore, more

or less the same as the Rs. 4,74, 255 crore spent

in 2003-04. Since plan expenditure is budgeted to

rise by Rs. 24,000 crore, from Rs. 1,21,507 crore

to Rs. 1,45,590 crore, the Finance Minister has had

to budget for an almost equivalent reduction in non-plan

expenditure from Rs. 3,52,748 crore to Rs. 3,32,239

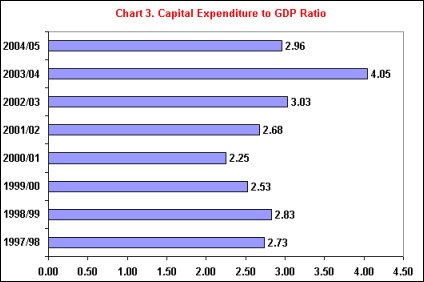

crore. This has been ensured through a huge reduction

of budgeted capital expenditures on the non-plan account

from Rs. 67.946 crore to Rs. 38,589 crore, which has

not been matched by the increase in plan capital expenditures

from Rs. 43,421 crore to Rs. 53,747 crore. In sum,

the immediate casualty of fiscal conservatism is much

needed capital expenditure which would have helped

relax crucial supply constraints in the infrastructural

area, even while stimulating demand and ensuring growth.

|

|

This limit on aggregate spending has been accompanied

by a huge increase in the defence budget. In a surprise

move, the government has chosen to allocate an additional

Rs. 16,700 crore for defence, by increasing the defence

budget from Rs. 60,300 to Rs. 77, 000 crore over the

financial year. This increase is surprising since

even the interim budget had provided for only Rs.

66,000 crore for defence. Even granting that national

security is an important concern, this huge increase

in allocation seems unwarranted at a time when the

security situation can hardly be described as critical

and when problems such as an agrarian crisis, rising

unemployment and persisting hunger and malnutrition

are serious. In practice, the additional allocation

for defence exceeds the special allocation for the

NCMP, which sends out wrong signals about the priorities

of the government. And given the government's obsession

with the fiscal deficit, it is inevitable that this

increased allocation would have limited its expenditures

in other crucial areas.

|

|

The fall-out of this combination of fiscal conservatism

and largesse for defence is visible, for example,

in the reduced allocations for rural development and

employment. The total expenditure incurred by the

Ministry of Rural Development is estimated at Rs.15,061

crore in 2002-03 and Rs. 15,519 crore as per the revised

estimates for 2003-04. As compared with these figures,

the budgeted expenditure for 2004-05 is placed at

just Rs. 11,456 crore. What is more, this Rs. 4,000

crore reduction in expenditure relative to the revised

estimates for 2003-04 is largely on account of a sharp

fall in the allocation for rural employment programmes,

from Rs. 9,640 crore in 2003-04 (RE) to Rs. 4,590

crore in 2004-05 (BE). It could be argued that the

expenditure in 2003-04 was unusual, since it included

a Special Component of the Sampoorna Gramin Rozgar

Yojana (SGRY), aimed at augmenting food security through

food-for-work schemes in calamity affected areas.

But given the state of agrarian distress in most parts

of the country and the new government's stated commitment

to augmenting employment, the sharp fall in allocation

can hardly be justified.

|

|

In fact, with the government having committed itself

through the CMP to guarantee 100 days of employment

at the minimum wage to one member of every needy family

in the country, a substantial additional allocation

for employment generation was expected. The government

could argue that employment being created with existing

expenditures in various sectors could be used for

the purpose of implementing the guarantee. But if

existing allocations were enough to realise this objective,

then there would have been no need for a special guarantee.

The view that the special allocation of Rs.10,000

core to the Planning Commission can be used to realise

this goal is also not defensible. The wage and capital

expenditures together required for provision of 100

days of employment for a single individual in a year

would total Rs. 9,000. Assuming that on average about

one-third to two-fifths of households in the country

would opt for such employment, the expenditure required

to implement the employment guarantee works out to

around Rs. 45,000 crore. Hence the additional allocation

of Rs. 10,000 crore for the CMP would be inadequate,

especially since a significant part of that allocation

would have to go to meet the expenditures on education

to be financed by the special cess that is expected

to yield Rs. 4,000 crore for the purpose. The budgetary

allocation for all levels of education is, at Rs.

11,062 crore, only around Rs.800 crore higher than

the expenditure in 2003-04, indicating that the allocation

aimed at raising over time the expenditure on education

from 3.1 to 6 per cent of GDP has yet to be made.

Funding for that purpose would have to come out of

the sum earmarked for the CMP.

Overall, therefore, the budget does not seem to have

provided the finance to meet the various commitments

made in the CMP and referred to in Part A of the Finance

Minister's speech. But the sense of disappointment

generated by the budget does not end here. Another

area of concern is the fiscal relationship between

the centre and the states. It has been clear for some

time now that urgent measures are needed to help the

states recover from the fiscal crisis they have been

in, especially since the implementation of the Vth

Pay Commission's recommendations. While an increase

in resource transfers to the states through an increase

in their share in taxes would have to wait for the

Finance Commission's recommendations, immediate steps

in the form of enhanced Plan and non-Plan grants and

a restructuring of their debt by swapping low-interest

debt for high interest debt was called for. In particular,

the practice of the Centre charging the states an

interest rate on their borrowing from the Centre which

was much higher than the interest rate paid by the

Centre on its own borrowings had to be reversed. However,

even while recognising the need to strengthen the

hands of the state governments, which must necessarily

play an important role in implementing the CMP, the

budget makes no major effort to correct the fiscal

squeeze being faced by the states. Much is made of

the reduction of interest rates paid by the states

on borrowing from the centre from 10 to 9 per cent.

What was not mentioned was that the Centre today borrows

in many cases at interest rates which vary between

4 and 6 per cent, and lends to the states at 10 per

cent.

Despite these measures to curtail its expenditures,

even if at the expense of the realisation of its stated

objectives and commitments, the government would have

had to mobilise additional resources to finance its

activities and meet its self-imposed fiscal deficit

targets. Some effort in this direction is indeed visible

in the budget: primarily, the imposition of a transactions

tax on financial transactions in equity and debt markets;

and, an expansion of the coverage in taxation in services.

While such moves have to be welcomed, their impact

has been marginal because of the extremely low rates

at which those taxes have been levied, the marginal

increase in coverage and the concessions in other

areas that have accompanied these measures in the

name of rationalisation of taxes. In the event, the

additional resources mobilised through the budget

is meagre, forcing the Finance Minister to fall back

on an unusual source of additional revenue, viz. recovery

of tax arrears due from cases where the tax claims

have not been legally disputed.

Arguing that there is a kitty of close to Rs.18,000

crore under this head and assuming that he would be

successful in mobilising a significant share of that

kitty, the Finance Minister has made extremely optimistic

projections of tax revenue collections under different

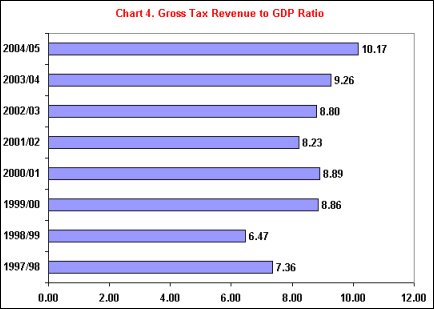

heads. Corporation taxes are estimated to rise by

41 per cent, income taxes by 27 per cent and excise

duties by 18 per cent. If these targets are realised,

the gross tax revenue to GDP ratio would rise by one

percentage point from 9.3 per cent in 2003-04 to 10.3

per cent in 2004-05.

There are no reasons whatsoever to believe that such

large additional revenues from taxes would actually

materialise. Hence, the final collections are likely

to be much lower than projected, forcing the government

either to reduce its expenditures even more than provided

for in the budget or to accept a much higher fiscal

deficit. Rather than lay himself open to that possibility

in the very first budget of the new government, Mr.

Chidambaram could have done better by making adequate

expenditure provisions, ensuring a higher level of

additional resource mobilisation and allowing for

a substantially higher fiscal deficit, given the context

of a demand constrained economy which makes that deficit

benign from the point of view of inflation.

The reason why the Finance Minister and his colleagues

did not choose that route seems to be their neo-liberal

mindset. In the event, inadequate moves on the development

front have been accompanied by policies that seem

to suggest persistence with the liberalisation agenda

of the previous government. Foreign Direct Investment

caps have been raised substantially in telecom, civil

aviation and insurance. Foreign Institutional Investors

have been provided a range of concessions in the form

of lower capital gains taxes, greater access to the

debt market and higher ceilings for their shareholding

in different sectors. Banks are to be encouraged to

increase their speculative exposure to the stock market.

And privatisation is to be persisted with in the name

of "piggy-backing" on new share issues by

profit-making companies like the NTPC.

Given the mindset these policies reflect, an adherence

to fiscal conservatism and the adoption of a market-friendly

taxation framework was inevitable. Unfortunately,

however, the nature of the mandate obtained by the

new government required it to depart from neo-liberalism

and redirect economic policy in favour of the poor.

Faced with this dilemma the Congress-led government

has made some moves that are suggestive of a new agenda.

But overall it seems to have adopted the soft option:

it has dressed the budget in pro-poor rhetoric but

chosen not to implement what it claims it has set

out to do.

For more articles on this topic

click here

July 12, 2004.

|