Well

before the financial crisis broke out so violently

in the US and caused ripple effects all over the world,

most people in developing countries were already reeling

under the effects of dramatic volatility in global

food and fuel markets. In 2007 and 2008 prices of

most primary commodities first increased very rapidly,

to a degree that was completely unwarranted by actual

changes in global demand and supply. Then they collapsed,

from peaks in May-June 2008, at even more rapid rates

than their previous increases. But in many countries

the fall in global prices was not associated with

a fall in prices paid by consumers, while the actual

producers (such as farmers) rarely benefited from

the price increases.

It is now quite widely accepted that financial activity

- specifically the involvement of index investors

- was strongly associated with these dramatic price

movements. Commodities emerged as an attractive alternate

investment avenue for financial investors from around

2006, when the US housing market showed the initial

signs of its ultimate collapse. This was aided by

financial deregulation that allowed purely financial

agents to enter such markets without requirements

of holding physical commodities. This generated a

bubble, beginning in futures markets that transmitted

to spot markets as well.

Thereafter - even before the collapse of Lehman Brothers

signalled the global financial crisis - commodity

prices started falling as such index investors started

to withdraw. The global recession that was evident

from mid 2008 led to perceptions that commodity prices

would not firm up any time soon. While this contributed

to fears of deflation in the context of liquidity

trap conditions, this was even seen to be an advantage

especially for food and fuel importing developing

countries, whose import bills would be reduced accordingly.

But while the collapse in commodity prices after the

recent peak was sharp, it proved to be quite short-lived.

Most important commodity prices - especially food

and oil prices - have been rising from early 2009,

even before there was any real evidence of global

''recovery''.

Chart 1

Chart 1 shows that global food prices, which nearly

doubled between June 2007 and June 2008, fell very

sharply thereafter and were back to the June 2007

level by December 2008. But thereafter they have been

rising once again, such that the increase between

December 2008 and November 2009 has been more than

16 per cent on average across all food commodities.

Agricultural raw materials prices did not rise as

quickly and fell more in the second half of 2008,

so their recent price increase has been sharper, close

to 35 per cent in the seven months between May and

November 2009. But this means that they are on average

only just back to the level of two years earlier.

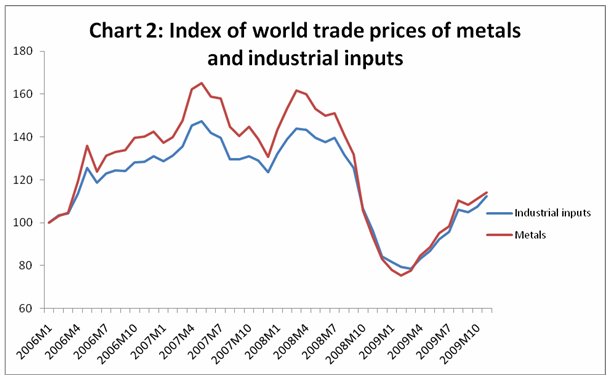

Chart 2

Other non-agricultural primary commodities

- metals and other industrial inputs, showed less

price increases during the 2007 commodity boom, more

volatility over the course of 2008 and sharper falls

thereafter, so that by the beginning of 2009 their

prices were below those of January 2006 (Chart 2).

But these prices have exhibited particularly pointed

recovery since then, increasing by more than 50 per

cent in the case of metals between March and November

2009, and by 43 per cent in the case of other industrial

raw materials.

Of course energy prices are particularly crucial,

and here the recent trend in both all fuel prices

(including coal) and only petroleum prices, has been

quite marked as well. Chart 3 shows a picture of great

volatility, but the extraordinary price increases

of 2007 to mid 2008 and the subsequent fall tend to

reduce the attention to more recent trends. Thus,

in the eleven months of 2009 for which the data are

now available, fuel prices have increased by 53 per

cent and oil prices have increased by 88 per cent.

In any other period such increases would be the object

of widespread attention and the subject of endless

commentary. But because we live in such ''interesting

times'', with a recent history of even greater and

more rapid increase and decrease, they have largely

gone unnoticed.

Chart 3

Why is this happening? And what

does it portend for the future? It was noted earlier

that the recovery in most primary commodity prices

actually predated the global output recovery. As was

the case in the previous price surge of 2007-08, these

recent price increases are unlikely to be related

to any real economy changes in demand and supply.

Despite some supply shocks in particular crops, according

to the FAO most agricultural goods in 2009 showed

approximately the same demand-supply relationships

that existed in the previous years, with no force

making for any significnt upward or downward price

trend. So if prices are increasing, it must be because

of the effect of expectations combined with heightened

speculative activity in commodity markets, especially

in commodity futures.

Indeed, there is no reason for such speculation to

be curbed at present; if anything, the low interest

rates that are being maintained by most major economies

as part of the recovery package, combined with the

immense moral hazard generated by the large financial

bailouts, are likely to have made the appetite for

risky behaviour much larger. Both gold and other primary

commodities are once again emerging as prime areas

of interest for financial institutions, and some of

the large (and succcessful) financial players such

as Goldman Sachs are expanding or opening new commodity

investment sections.

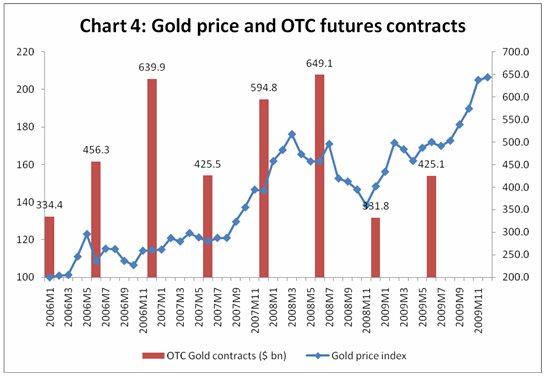

Chart 4

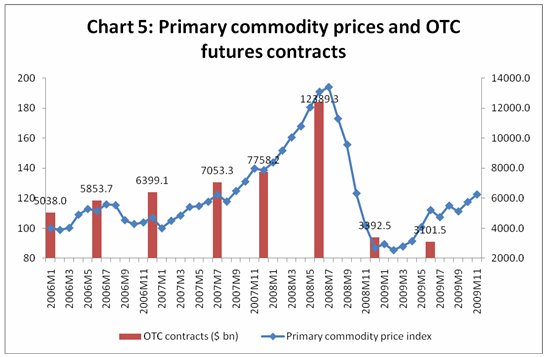

Chart 5

As Charts 4 and 5 indicate, the value of OTC (over

the counter) futures contracts in both gold and other

commodities has tended to track spot price movements.

Since OTC contracts do not occur in regulated exchanges

(and in any case effective regulation that would constrain

speculative activity in commodity futures is not yet

in place in any of the major financial centres) such

activity still has the potential to cause wild swings

in commodity prices that are not justified by any

fundamentals.

This creates a piquant situation for economic policy.

In macroeconomic terms, the global threat of deflation

is still greater than that of inflation, especially

because the financial crisis is far from resolved

or even properly dealt with and is bound to result

in new problems in real economies sooner rather than

later. However, both the nature of the recent recovery

and the policy response to the crisis (which has provided

more liquidity without adequate control or regulation)

suggest that primary commodities may well witness

a price surge once again.

Such price surges have huge negative implications

for developing countries. Because they are the result

of financial activity, they typically do not benefit

the direct producers who may be resident in the developing

world. But they cause huge damage to consumers of

food and other essential items, typically the poor

in developing countries who are the worst affected

as the prices of necessities increase even as their

employment and wages continue to languish.

If these very adverse effects are to be avoided, financial

regulation to curb speculative activity in commodity

markets must become an urgent priority at both national

and international levels. The governments of large

developing countries that are now beginning to flex

their muscles at various international fora would

to well to recognise the critical urgency of such

measures, if they really want to benefit their own

people in international negotiations.

January

13, 2010.

|