Liberal opinion holds that the international monetary and financial system is a device for promoting…

The mistaken obsession with the fiscal deficit C.P. Chandrasekhar and Jayati Ghosh

It’s that time of year again – the time when all eyes turn to those magic numbers, the actual and proposed fiscal deficits of the central government as shares of GDP. Breathless news anchors will interrogate financial investors on what the numbers mean, and why 3.5 per cent or 3.7 per cent is fatally worse than, say, 3.4 per cent or 3.2 per cent or less. Everyone will breathe a sigh of relief if the Finance Minister achieves his fiscal targets, while there will be gloom, doom and concern if the government is found to have overstepped.

All this scrutiny presupposes that the numbers the government generates for the Budget are an accurate description of actual spending and revenue collection, and that it has estimated the likely GDP more or less correctly. But suppose none of this is true? Suppose both the revenue and expenditure statistics are fudged, and give no real indication of the fiscal or revenue deficit?

This is essentially what a damning report from the CAG suggests. The Report of the Comptroller and Auditor General of India on Compliance of the Fiscal Responsibility and Budget Management Act, 2003 for the year 2016-17 (Report No 20 of 2018) says that the central government overstates its receipts and understates its expenditures. In effect, its fiscal and revenue deficits are both much larger than what is presented in the Union Budget.

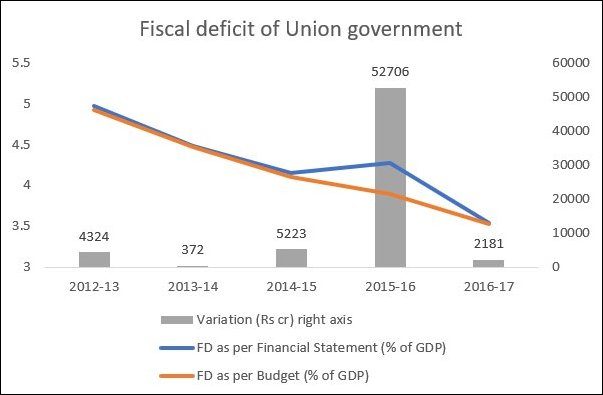

To start with, there is the problem that the Budget documents differ from the Annual Financial Statement (a statement of receipts and expenditure) laid before both the Houses of Parliament in compliance with Article 112(1) of the Constitution. Figure 1 shows that this has varied dramatically in some years like 2015-16 – something that the government has sought to explain on the grounds that “fiscally neutral” non-cash transactions have been netted out.

Figure 1

However, the bigger problem is not this somewhat simple lack of transparency, but the more obvious fudges. This is most stark in terms of spending that is simply not included in the Budget, in the form of off-budget financing. This has been used for deferring fertilizer subsidy arrears through special banking arrangements; implementing the irrigation scheme (AIBP) through borrowings by NABARD; railway projects financed through borrowings of the IRFC and power projects through the PFC. (CAG Report page 33)

Obviously, such off-budget financing is not open to Parliamentary scrutiny, defeating the very purpose of Government presenting the Budget to Parliament. And in addition to its implications for fiscal indicators, it creates future liabilities and can increase future subsidies provided for interest payments. Since this practice affects the cash flow of these public companies, the Finance Ministry has ‘Special Banking Arrangements’ (SBAs) in which loans from public sector banks are arranged to make payments against arrears of subsidies with some selected companies. Government makes payments of interest on these loans at Government Security (G-sec) rate, but interest over and above this rate is borne by the companies.

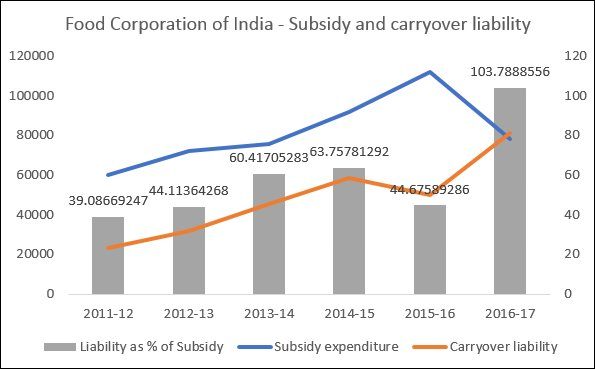

Consider, for example, the mess created for the Food Corporation of India. Every financial year, a certain budget allocation is made to the Ministry of Consumer Affairs, Food and Public Distribution, which also includes the payments of the food subsidies bill. If the subsidy bill turns out to have been greater, instead of paying it, the central government simply carries it over to the following year. Figure 2 shows how this amount has been growing over the years, to the point that in 2016-17, the unpaid carryover was greater than the amount of the food subsidy! In other words, the actual food subsidy bill was more than double the declared amount.

How does the FCI manage given these large and growing subsidy arrears? It borrows. In 2016-17, the FCI had to issue bonds (Rs 13,000 crore), take on unsecured short-term loans (Rs 40,000 crore), pilfer the National Small Saving Funds (Rs 70,000 crore) etc. All of these add unnecessarily to its future interest obligations, which the central government will eventually have to pay.

Figure 2

What the CAG did not mention is that the receipts are also increasingly manipulated. For example, public sector companies are being forced to buy up other public companies so as to push up the privatisation receipts – and they finance these purchases by borrowing, thereby adding to the government’s future liabilities.

What it boils down to is that the fiscal and revenue deficit numbers are significant underestimates. But then the question is, has anyone noticed? Why do we aim for particular ratios of these deficits to GDP anyway? The standard answers are: to prevent inflationary tendencies, to reduce the possibility of current account imbalances, and to keep the public debt within sustainable levels. But these are broad tendencies that should be affected by broad changes – why should a minor deviation from some arbitrary target make any difference?

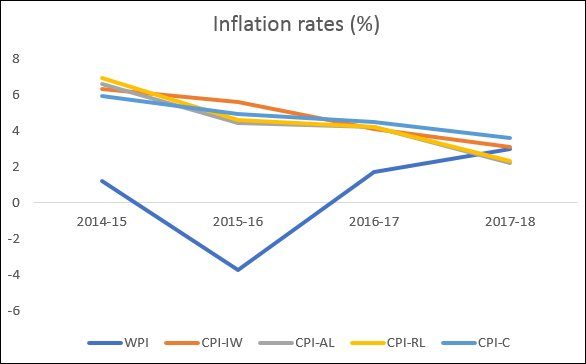

It turns out that the macroeconomic pattern has barely changed despite these large and growing fudges. Indeed, as Figure 3 suggests, inflation moderated (and the WPI changes was even negative in one year) despite the fiscal deficit actually being higher than was presented in budget documents, and total public sector borrowing requirement being significantly higher.

So the obsession with the fiscal deficit as a share of GDP as the single most important number is misplaced. It is also counterproductive, as it makes the central government resort to all sorts of low tricks to hide the reality, which in turn end up costing public sector companies, taxpayers and the economy much more over time.

(This article was originally published in the Business Line on January 28, 2019.)