The Kazan summit of the BRICS countries was a historic one for several reasons: first,…

Recent growth in the Indian economy Jayati Ghosh

What does one make of the Indian economy? It is now declared to be the fastest growing in the world, “the one bright spot in an otherwise gloomy world economy” according to IMF Chief Christine Lagarde, apparently on course to “become a key engine of global growth”.

There is no doubt that the economic potential of India is huge: now with more than 1.2 billion people, with hundreds of millions of people with middle class aspirations who will constitute a huge and growing market. Over the decades the economy has diversified to some extent, even if the share of manufacturing has remained relatively low, with some modern services emerging as the major growth sector. As an oil importer, it has been a major beneficiary of the low global oil prices, and with more diversified exports, it has not been so badly hit by the declines in other primary commodity prices. India’s Prime Minister Narendra Modi has been an avid traveller, presenting to the world an image of a dynamic would-be superpower full of optimism for the future.

Remarkably and thankfully, it is still a vibrant if chaotic democracy, notwithstanding the current central government’s attempts at stifling political dissent in various ways and an aggressive push towards majoritarianism, based on an unpleasant and intolerant version of what is actually a much more nuanced and liberal Hindu religion.

Yet India has always been awash with contradictions, in society and polity and not least in the economy, and these contradictions seem if anything to have accentuated in recent times. The economy apparently grew at a healthy pace of 7.6 per cent in the fiscal year until the end of March 2016, and is projected to expand by more than 7 per cent in the current fiscal year as well. But all the other indicators that one would expect to perform well with such buoyant output growth are behaving strangely, or even moving in the opposite direction.

Total food grain output in 2015-16 was no higher than in the previous year, despite some increases in crop output and agriculture value added. Industrial production has been sluggish at best, with the index of industrial production for June 2016 only 2.1 per cent higher than a year earlier, and that too following a dreadful period over 2015-16 when it actually declined in three out of four quarters. The production of capital goods has continued to decline.

This reflects the other strange feature: domestic investment rates have been falling, despite all the so-called dynamism. On an annual basis, the rate of capital formation declined from 39.4 per cent in 2012-13 to 35.9 per cent in 2014-15, with declines in each consecutive quarter. Capital formation in manufacturing fell from 9.4 per cent to 8.1 per cent of manufacturing output over the same period. And the decline continues: the most recent data suggest that fixed capital formation as a proportion of GDP in April-May 2016 fell by a further 3 percentage points (to 29.6 per cent) compared to the same period the previous year. So while Mr Modi exhorts global business to “come, make in India”, it appears that Indian corporates are less anxious to do so, and show few indications of the confidence that would spur increasing investment.

Meanwhile, external trade provides a negative impulse. Exports (in US dollar terms) fell by nearly 16 per cent in April-June 2016 as compared to the same period in 2015, and the decline was slightly less in rupee terms (just under 10 per cent) only because of rupee depreciation. Over the same period, imports – both oil and non-oil imports – also fell by around 15 per cent, leading to a minor decline in what is still a large trade deficit. Even more worrying, services exports (considered to be an engine of growth even though their share of GDP remains small) also declined by 2 per cent, and there was a much sharper decline in the trade balance or net exports of services, by 21 per cent.

Aggregate employment figures are collected only every few years rather than annually, but the available data for some important industries suggests stagnation or even decline in employment. A quick survey conducted by the Labour Bureau found that there was some increase in employment in the selected sectors in September 2015 compared to same month in the previous year, but this was mainly in the IT/BPO sector and textiles and garments, while employment in automobiles, gems and jewellery, and transport actually declined. However, a net increase of only 272,000 jobs in eight major sectors over a full year (in an economy in which the work force is estimated at around 500 million) is hardly a positive sign.

Indeed, the perception that aggregate employment generation is stagnant at best is reinforced by the fact that only around 4 per cent of workers can be considered as “formal”, that is, covered by contracts that provide even minimal workers protection. Rural-urban distress migration, which had reduced following upon the introduction of the rural employment guarantee programme from 2006 onwards, has renewed again as the government has reduced spending on the programme and on other public services that affect people in rural areas. Rural real wages, which rose sharply from 2007 onwards, began to fall in late 2014 and have been falling since – surely quite remarkable for an economy growing at 7 per cent or more.

So how does all of this square with the picture of a buoyant economy growing at such a rapid rate? More precisely, what is it composed of and where are the fruits of this growth going? There has been quite a controversy around the recent revision of India’s GDP data, but in the absence of anything better, consider the recent pattern of growth as indicated by this new series of national income estimates.

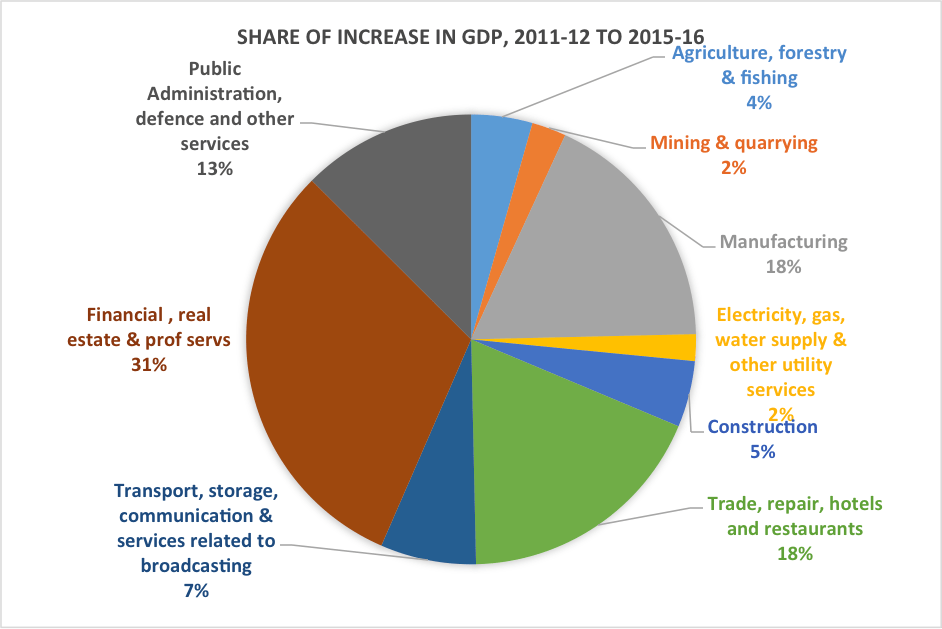

The chart below suggests that recent growth has remained service-led, and that too, largely finance-led. In the period between 2011-12 and 2015-16, nearly one-third of the GDP growth came from FIRE (finance, insurance and real estate along with related professional services) – something that should ring warning bells to anyone even slightly familiar with financial booms and busts across the world in the past two decades. The service sectors taken together accounted for nearly 80 per cent of the total GDP growth. Construction, which was a major driver of the economic boom from 2004 onwards until about 2011, has contributed to only 5 per cent of recent GDP growth and even manufacturing has contributed less than one-fifth.

The concern is that – quite apart from the greatly increased reliance on potentially volatile non-tradeable sectors for expansion – none of these more dynamic sectors has been generating too much employment, and particularly very little formal employment. The increased GDP contribution of FIRE and public administration services have not come so much from more employment, but rather from increased salaries and per worker incomes. Since these are not reflective of “productivity” increases, they are not a particularly encouraging sign of the health of the economy. So the pattern of largely jobless growth that has been a feature of the past three decades looks set to continue.

All this results from the fact that the economic strategy of the current NDA government is broadly the same in essentials as that of the previous much maligned UPA government in its second term. It boils down to these principles: Offer various fiscal and other incentives to large business, in the hope that they will invest more and thereby increase both output and formal employment. Allow labour market inequalities, low wages and terrible worker conditions to persist in the hope that these too will attract capital. Avoid reliance on direct public investment in both physical and social infrastructure; instead, rely on “public private partnerships” that keep all the risks with the public sector and may involve continuously increasing incentives to private players. The current Modi regime has added to this mix with ferocious cuts in essential social spending in areas like health, education and so on, on the specious claim that state governments can now afford to undertake such expenditure on their own.

This strategy had stopped working in the final years of the UPA government, and so it is not surprising that it is not working now either. The odd thing is that, while foreign investors and the global financial media appear to salivate at the possibilities of the huge Indian market, the Indian government itself does not seem to recognise this potential. Instead, it persists in seeing wage growth as higher costs rather than as a source of demand, and obstinately undermines the future potential for growth by reneging on the state’s obligation to build and provide physical and social infrastructure.

Without a significant shift in the approach to economic policies, therefore, in the near future the promise of the Indian economy is unfortunately likely to remain just that.